We’ve had a lot of users ask if they can use inFlow instead of small business accounting software. The quick answer is that inFlow Inventory is focused on inventory control and order tracking, but they do have features to help you keep on top of your finances.

The more nuanced answer is that we don’t think of inFlow and accounting as mutually exclusive, but rather as complementary types of applications. inFlow is laser-focused on tracking products and stock levels, while accounting apps are great at balancing the books.

In this article we’ll discuss the most common small business accounting needs. We’ll spell out which numbers you can track with inFlow, and what you’ll still need a dedicated accounting app for.

What kind of accounting stuff can inFlow do?

We can’t speak for everyone, but we have spoken to thousands of small business owners from around the world. Based on those rounds of feedback, we’ve made sure that inFlow can track what most small businesses care about.

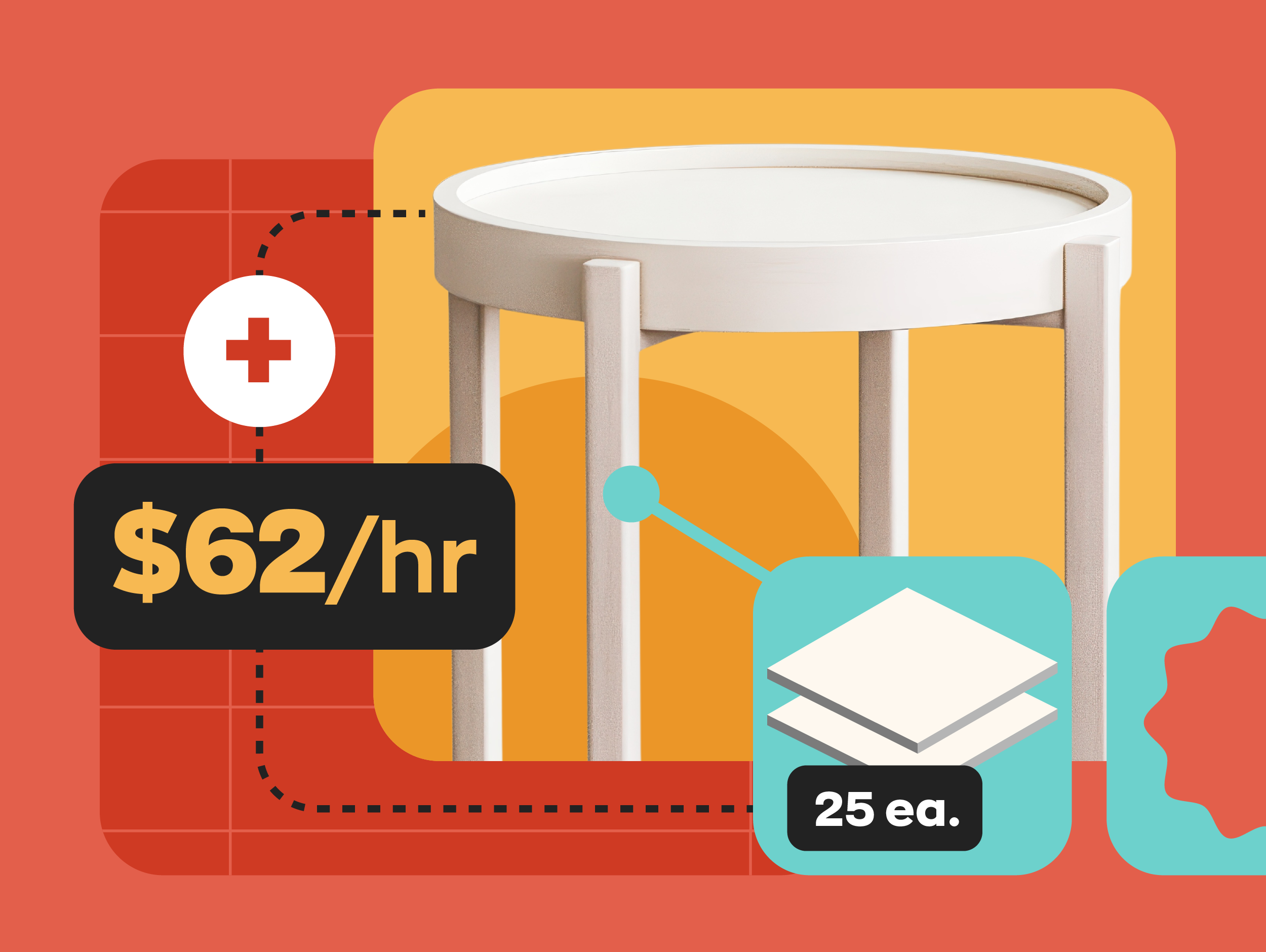

Specifically, inFlow helps you track how much you’ve spent on buying products, from the individual unit prices to the shipping and customs fees. The default settings in inFlow bake all of those incurred costs into your product’s final cost, which makes profit calculations a lot easier.

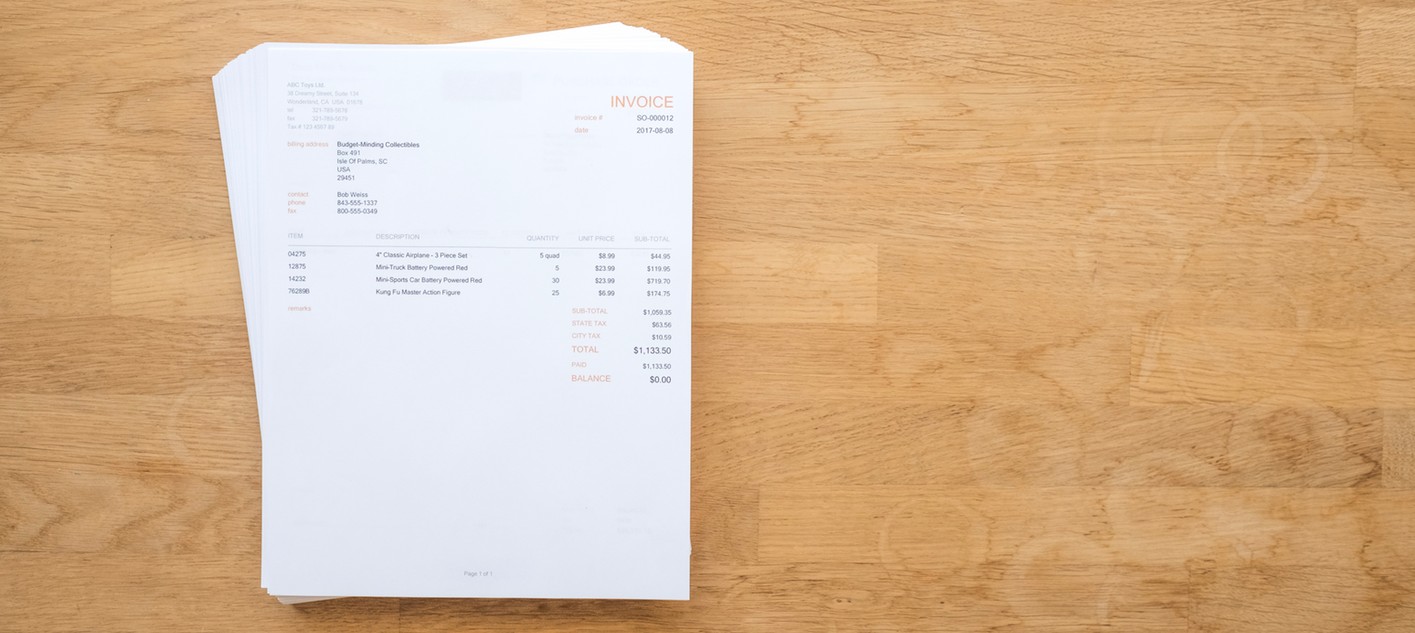

inFlow also helps you track how much money your business has made by selling your products and services. Sales Orders can track non-customer costs (like service fees from e-commerce sites), and inFlow calculates profit on every sale you fulfill.

inFlow’s fixed markup feature can also ensure that you’ll always make a profit on selling your products, no matter how much your business paid for them.

[For more on what markup means, see our dedicated Margin vs. Markup article!]

When it’s time to review sales at the end of the day or week, you can run reports on individual products or entire orders to check your gross profit, which is the amount your business made by selling products and services.

How to handle other small business accounting stuff

Order and inventory management is our software’s forte, but there are a few things you’ll have to track outside of inFlow (likely in a dedicated accounting app).

These include:

- Business expenses like lunches and plane tickets

- Overhead like renting an office or paying utilities

- Payroll for tracking employee hours and wages paid

- Tracking cash flow each month

- Balancing the books for different expense accounts

- Connecting incoming payments directly to your bank statements

Depending on the size of your business, you may not need a dedicated service to help you track those things. If you’re just a handful of employees right now, then your payroll and expenses can probably still be handled by spreadsheets.

As your business expands, dedicated accounting apps and services like QuickBooks Online or Xero can help you handle balances, cash accounts, and payments. However, these services are not tailored to tracking stock levels and product movement. So the best solution we’ve found is to use each service in the area where it is strongest.

inFlow may not be able to track all of what a small business accounting app can, but both versions of inFlow feature CSV (spreadsheet) exports. This means you can use inFlow to track your products and orders, and then import it as spreadsheets into your preferred accounting service.

Using both inFlow and an accounting app like QuickBooks Online or Xero provides you with a complete overview of your business, while still providing experiences tailored to each kind of task.

Want to experience inFlow for yourself?

If you’re not already an inFlow user, you can easily start a free inFlow Inventory trial today!

i was wondering if there is an add on to inflow that helps us with the accounting side;

As an owner of a small business to be launched, i am looking for an all in one package that cover everything needed.

what additional things to be added to inflow to cover all the needs for a new beginner small business please? which version is recommended if i am the only user?

Hi Rabih,

If you need to track several cash or credit accounts and handle things like payroll, these are better suited to dedicated accounting apps like QuickBooks Online. If you’d like to get your data out of inFlow and into an accounting app, we do have some handy export guides on our support page: https://www.inflowinventory.com/support/article/41139804/how-do-i-export-data-or-other-transactions-from-inflow/

If you’ll be the only user of inFlow, you’d only need one license (either Regular or Premium). If you needed multiple users later on, you could buy extra licenses as needed.

hello

Can inflow intergrate with SAP Business One ?

thank you

Hi Hassan!

Sorry, we don’t have any planned integration with SAP Business One at this time as there is some feature overlap (both inFlow and SAP can manage inventory), but I’ve recorded your feedback and sent it along to our developers!

Hi there,

Can inflow integrate with Xero?

Hi Alanna, sorry our accounting integration is with QuickBooks Online right now. But we have heard requests for Xero before, so I’ve recorded your feedback for our developers. If we do integrate with Xero in the future, we’ll make sure to get in touch!

Are you working onan integration between QuickBooks and xero?

Hi Chirene, sorry we don’t have any plans for direct integrations between QuickBooks and Xero at this time. We do have an integration that sends sales data from inFlow Cloud to QuickBooks Online, though, and that is live right now.

I am using Sage 50 does inflow integrate with Sage??

Sorry we missed this one Anthony, but I’m answering late in case it helps others. We don’t integrate with Sage 50, but if your business has some developers, they could use inFlow’s API to make a custom connection to other services like Sage.