Key takeaways

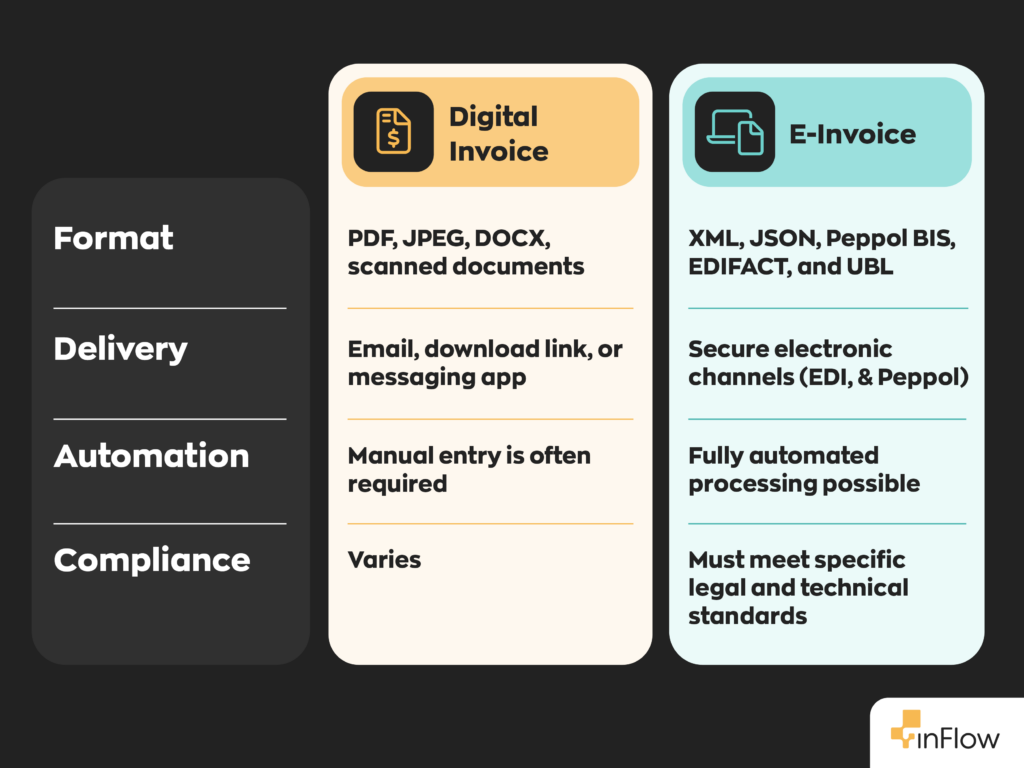

- An invoice is a document or record between a buyer and vendor. An e-invoice and digital invoice are both electronic alternatives to traditional paper invoices.

- E-invoices differ from digital invoices in that they follow a structured format and enable full automation. Digital invoices refer to any non-physical invoice regardless of the data format.

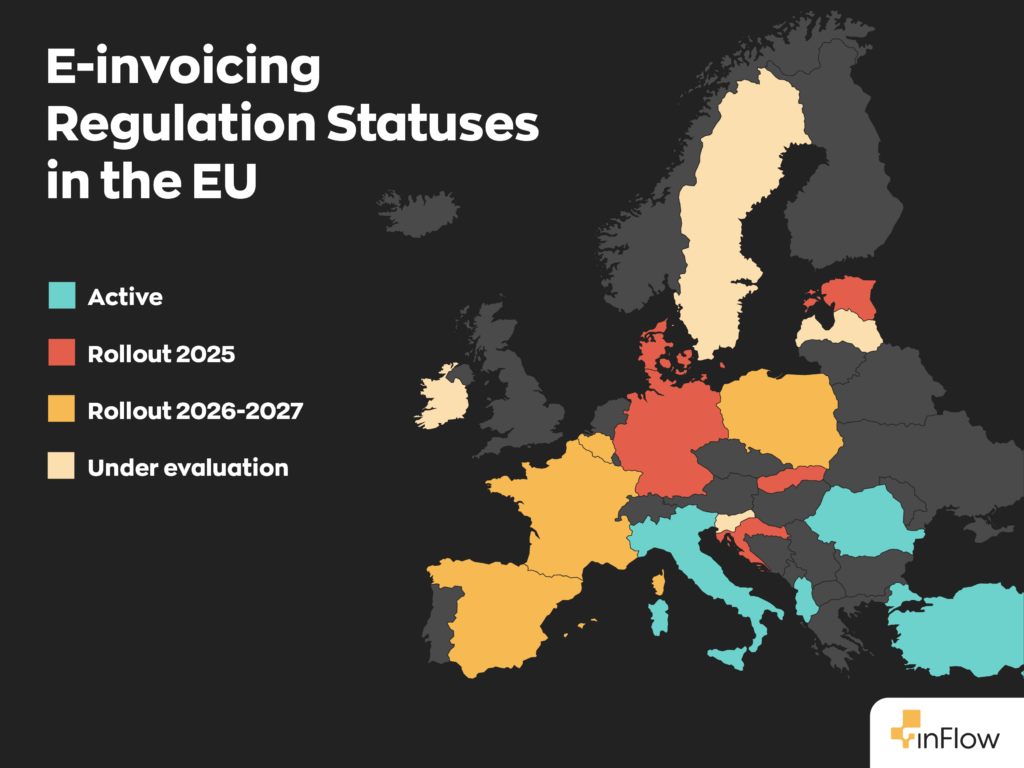

- Many countries within the EU require businesses to provide e-invoices.

- Some common data formats for e-invoices are XML, JSON, Peppol BIS, EDIFACT, and UBL.

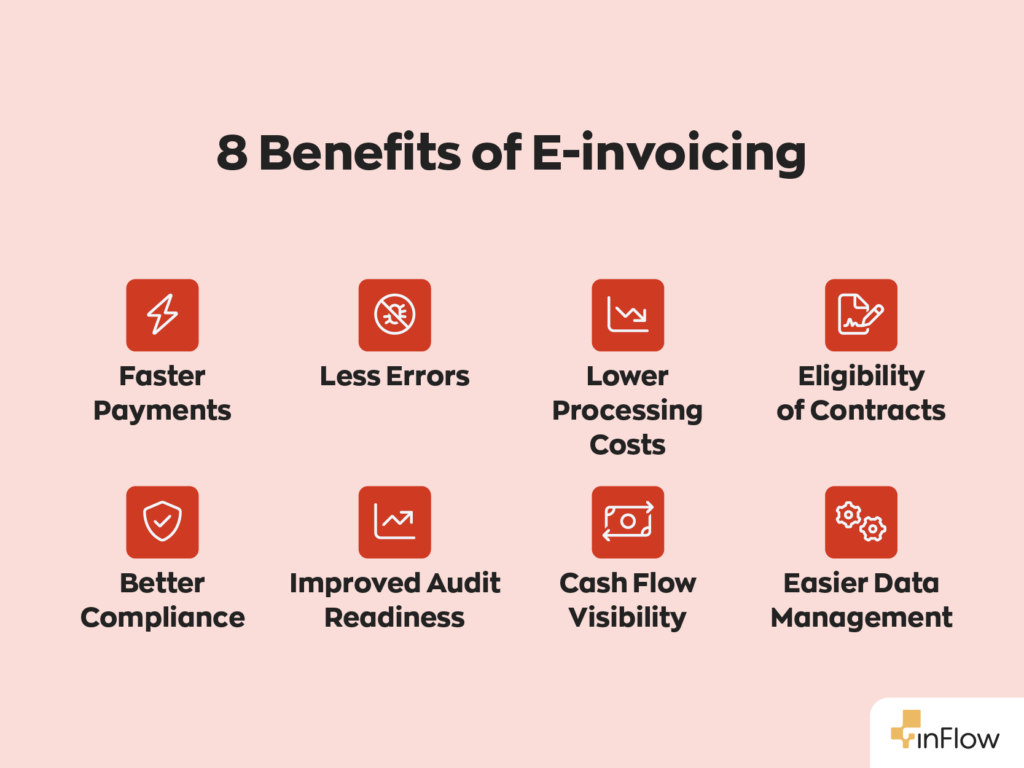

- The benefits of e-invoicing include faster payments, fewer errors, reduced costs, and better eligibility for government and enterprise contracts.

- inFlow supports digital invoicing and integrates with QuickBooks and Xero, making it easy to manage inventory while your accounting tools handle e-invoicing compliance.

Invoicing may not be the most glamorous part of doing business, but it plays a crucial role in keeping your day-to-day operations running smoothly. Thankfully, sending and receiving invoices has never been easier with the introduction of e-invoices. These digital documents speed up payments, reduce errors, and provide an abundance of other benefits that businesses of all sizes love.

But in the many parts of the European Union (EU), e-invoicing isn’t just about adding convenience to your workflow—it’s about adhering to the law. Several EU countries have already implemented rules and guidelines for business surrounding e-invoices, and more countries are planning to follow suit.

In today’s article, we’ll go over e-invoices and how they differ from traditional and digital invoices. We’ll also discuss their benefits, challenges, compliance requirements, and how to implement them.

What is an e-invoice?

An invoice is a document between a buyer and a seller that details all sorts of relevant information, such as the goods or services, how much they cost, the date of the transaction, and so on.

Following that logic, it only goes to reason that e-invoicing refers to sending, storing, and processing them digitally. Right? Not quite. See, in the business world, there’s actually a distinct difference between digital invoices and e-invoices.

Generally, e-invoices are issued, sent, and received in a structured digital format and processed directly into an automated system. Notably, this process doesn’t require human intervention- it’s all handled by software.

On the other hand, “digital invoice” simply refers to any invoice that is not on paper. In other words, any invoice that’s digital. However, this doesn’t mean they’re part of an automated system. They could simply be images stored as PDFs and sent manually between individuals.

In other words, every e-invoice is a digital invoice, but not every digital invoice is an e-invoice. It’s a small distinction but an important one nonetheless.

What benefits does e-invoicing bring?

There are quite a few benefits to implementing e-invoicing. Many of those have to do with the nature of storing invoices in a digital format. It’s easier to store, easier to manage and organize, and easier to search for relevant information. Not to mention, programs can pull data from e-invoices much faster to create financial reports.

Another advantage of e-invoicing is that it standardizes data sharing across the supply chain, which means everything is faster and less susceptible to mistakes. This speeds up payment processing and cuts down on both cost and waste.

It’s also worth mentioning that some public sector entities and large corporations only accept e-invoices. This means they will likely reject any paper invoices you submit. Not having the capacity to deliver e-invoices will ultimately mean you won’t be able to bid on government contracts or work with large corporations.

Aside from the many benefits e-voicing brings, it’s also mandatory in some areas of the EU.

E-invoices are mandatory in parts of the EU

In April 2017, the EN 16931 standard was published by the European Committee for Standardization (CEN). While this standard first mandated using e-invoices for B2G (business to government) transactions, it differs from country to country.

For example, Germany won’t have mandatory e-invoicing until January 2026. Finland, on the other hand, has required e-invoicing since April 2020. For a more detailed look at European legislation, check their website here.

If you operate in the European Union- and especially across multiple countries- make sure to check their individual laws. What may be compliant in one might not be compliant for their neighbors.

Where does e-invoicing fit into EDI?

E-invoices themselves are just one part of the electronic data interchange (EDI) landscape. It’s existed since the 1960’s and operates with a straightforward purpose. To make sharing information between businesses easier.

Think of the last image you took, opened, or saved on your phone. It could have been one of a few file types; such as JPEG or PDF. It might not appear any different to the human eye, but it has a different data structure behind the scenes.

Now, imagine if your phone could only read one of those types. You’d be able to tell that it’s an image, but not be able to open it.

While perhaps not a one-to-one comparison, it’s that exact issue that EDI and e-invoicing attempt to solve. Having an easy-to-use, accessible data format makes communications between businesses easier. It also makes internal processes more straightforward while cutting down on overhead costs. One of the goals of e-invoices is automation, after all.

As for government entities, it makes collecting and processing financial data much more effortless. In the case of the EU, one reason e-invoicing is mandatory is because of the value-added tax (VAT).

Common e-invoice formats

Not all e-invoices will use the same format. Different countries and regions may require specific formats for their e-invoices. Here are some of the most common ones.

XML

XML stands for extensible markup language. It’s a flexible markup language used for storing, transmitting, and organizing data. Unlike other programming languages, XML has no computational capabilities. It encodes documents in a format that is both machine and human-readable. This format is very common for e-invoicing.

JSON

JSON, or JavaScript Object Notation, is a text format for storing and exchanging data. Web applications frequently use it to transmit data between a server and node. Like XML, JSON is both human and machine-readable. It’s worth noting that JSON is generally simpler than XML and has seen increased popularity due to this fact.

Peppol BIS

Peppol stands for Pan-European public procurement online. The BIS stands for business interoperability specifications. Peppol itself was initially used to improve public procurement across the EU. It later saw widespread adoption in the public sector as well. Peppol is based on XML.

EDIFACT

Electronic data interchange for administration, commerce, and transport. Developed by the UN Economic Commission for Europe (UNECE). E-invoices in Europe, as well as parts of Asia use this format.

UBL

Developed by an OASIS technical committee. There are no royalty fees associated with using the data structure. UBL, or universal business language is designed to plug and play into existing businesses. Like other structures, it’s designed to improve information exchange by streamlining the process.

The future of e-invoices

And, as with any technology, e-invoicing continues to improve- especially in relation to other technologies. Some notable changes include:

- Blockchain— One particular technology of interest is blockchains. While the term may conjure impressions of various cryptocurrencies, blockchains are something different. We won’t go in-depth here, but you can consider them a security measure. Because every computer functions as a node, they’re functionally impossible to hack.

- AI— And of course, AI is another technology to keep an eye on. It’s already gone to work in e-invoicing, most notably increasing accuracy while also offering a greater degree of automation.

- Smart contracts—These new types of contracts can automate the entire invoice-to-payment process. They are designed to automatically carry out the terms of a contract once certain conditions are met. This completely eliminates the need for intermediaries.

A step-by-step guide to implementing e-invoices

We’re not going to sugarcoat it. If you want to start e-invoicing, there will be some initial challenges, but the value they add is well worth it. Here’s how you can make the transition.

- First, you’ll need to assess your current workflow and map out how your business handles invoices. Then, identify and make note of any bottlenecks and compliance gaps.

- To ensure you stay compliant with your region’s regulations, look up the e-invoicing requirements for your country or industry. This will determine your technical and legal needs.

- Next, you’ll need to find software that supports structured e-invoices, integrates with your existing systems, and complies with local mandates (ex. Peppol-ready, EN 16931-compliant).

- Once you set everything up, try rolling it out with just a few clients or vendors to test the system. This should allow you to iron out any issues in a low-risk environment.

- Now that your new system has been tested and is ready to launch, it’s time to train your team. Proper onboarding and documentation will go a long way to help your finance and operations staff down the road.

- Just because you’ve set up your e-invoices doesn’t mean the work is over. Make sure that you monitor and track key metrics, such as invoice approval time, payment delays, and errors. This data will not only allow you to measure the success of your new workflow but also empower you to make any adjustments if necessary.

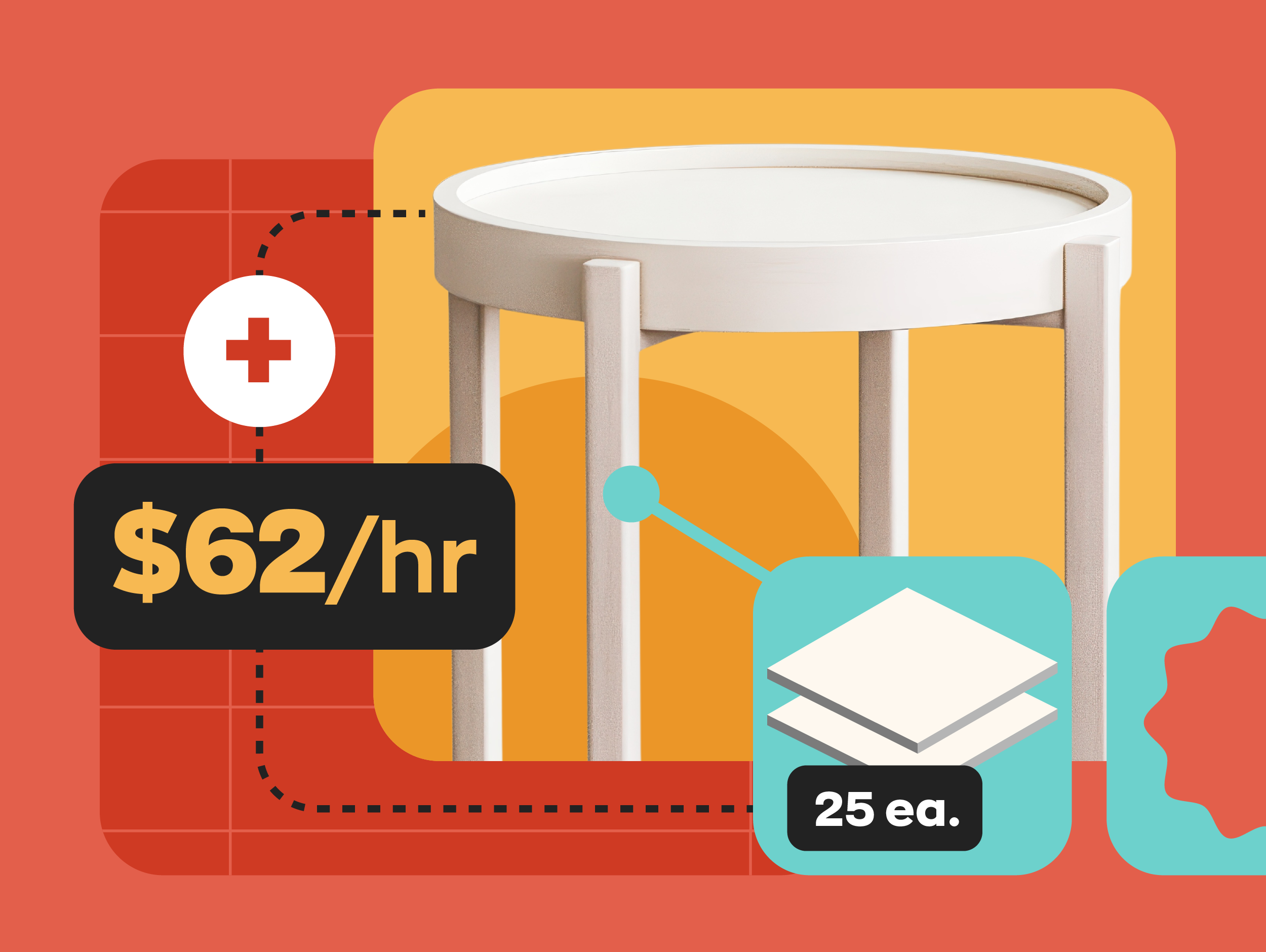

How inFlow can help with invoicing?

While inFlow doesn’t offer e-invoicing in the strict regulatory sense like software connected to Peppol or national tax systems, we do offer businesses digital invoicing features. Our inventory management system can create professional invoices quick and easy and send them directly to customers via email with a complete audit trail! You can also track payment status and get alerts on overdue invoices.

And even though we don’t support e-invoices natively, our customers can use our integrations for both Xero and QuickBooks Online to handle all their e-invoicing needs. So, you can let inFlow handle all your inventory and order management needs while your accounting software takes care of the books.

0 Comments