Key takeaways

- A fixed-price contract (also called a fixed-cost contract or fixed sum contract) sets a price from the beginning; no matter what, that will be the final payment.

- While risky, they offer small businesses who know their craft a chance to make a great profit while giving their customers peace of mind.

- Profiting from a fixed-price contract requires accurate demand forecasting and intimate business knowledge.

- Fixed-price contracts are not suitable for every business project. Generally speaking, they are a good fit for smaller, less complex projects with a clear scope of work.

Contractors have to deal with a lot of contracts. It’s in the name, after all! While these contracts generally share the same goal of defining payment for a project, they can differ significantly in structure. One of these types of contracts is the fixed-price contract or fixed-cost contract.

It’s common in many field service industries, such as construction, HVAC & plumbing, electrical, telecom equipment installation, etc. Today, we’ll be going over what a fixed-price contract is, when they’re useful, and when it might be better to consider a different type of contract.

What is a fixed-price contract?

As the name suggests, a fixed-price contract is a contract that stipulates the final payment from the very beginning. Unlike many other contracts, there’s usually no room for negotiation once the agreement is in place. It also provides no extra payment for unforeseen costs, like additional resources or manpower.

For this reason, fixed-price contracts leave little wiggle room for error. These types of contracts can be very attractive to the client/consumer since they offer them peace of mind. However, the contractors take on a massive risk if they’re not careful with their planning and budgeting.

What are the benefits of fixed-price contracts?

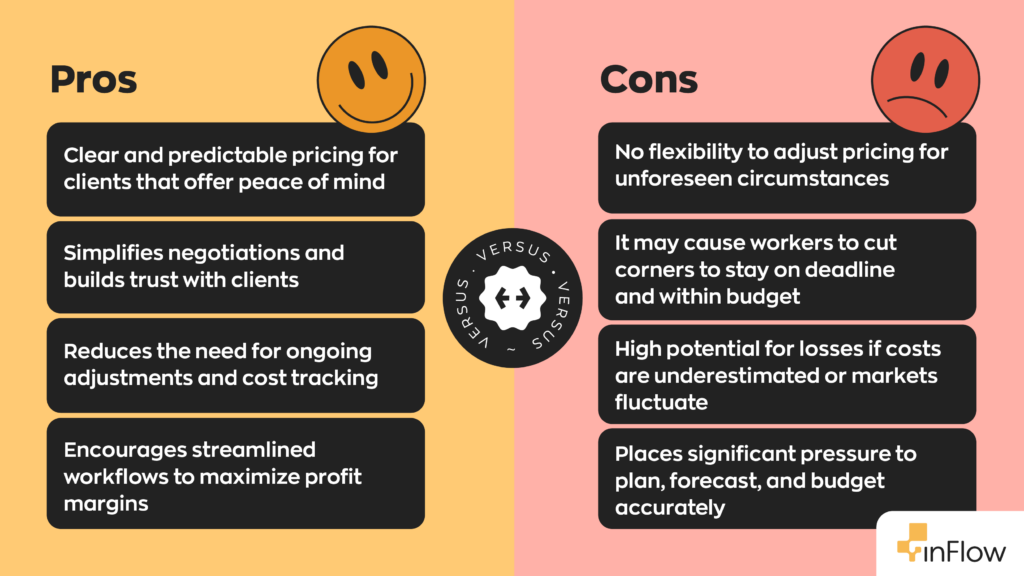

On the surface, lacking breathing room and a safety net might seem like a bad idea. But fixed-price contracts have their benefits.

The biggest advantage of these contracts (sometimes called fixed-cost contracts or fixed-sum contracts) is that they’re straightforward to understand. The buyer makes the final price clear from the start, and it’s up to the contractor to break it down. In many cases, that’s much easier than accounting for every cost along the way. It also cuts down the back-and-forth negotiations, which can expedite other processes.

Because of this, fixed-price contracts can also be exceptionally profitable. Businesses who know their work inside and out can often deliver the final project under budget, which means more profit in their pockets.

As we mentioned before, customers often prefer fixed-price contracts for the transparency they provide. Service providers like them because of how they incentivize more efficient workflows.

What are the downsides of fixed-price contracts?

Of course, there are downsides to every contract, and a fixed-cost contract is no exception. That’s part of why there are different types of contracts. Different projects and jobs often require different guidelines for both parties.

The biggest problem with fixed-price contracts is that markets are dynamic. Even the most stable markets see some price fluctuation, however slight. Depending on the project, an increase of even a few cents can equate to hundreds or thousands of dollars.

Unforeseen costs present another, even larger issue. It’s no real secret that sometimes, things just don’t go according to plan. That’s just part of life. But, unfortunately, when things go awry for contractors, it usually means they’re losing profit. Extraordinarily dire circumstances may also lead them to lose money on jobs if they’re under a fixed-price contract. For this reason, businesses should consider these contingency costs beforehand and bake them into the contract.

When should (or shouldn’t) you use fixed-price contracts?

Generally speaking, it’s best to use fixed-sum contracts when the scope of work is clear. But what does that mean?

Above, we mentioned a few different field service sectors where such contracts are popular. These sectors can typically define the scope of work beforehand. For example, a client may prepare an RFI, RFQ, or RFP, depending on the project stage. This allows contractors to do all the necessary number crunching to see how much they’ll need to complete the project based on past projects. By extension, this will enable them to work out roughly how much profit they’ll make.

Fixed-cost contracts are generally a bad idea when dealing with fluctuating markets. If the cost of project materials rise and falls quickly, it becomes near-impossible to determine price and profit.

Another consideration is the complexity of the project at hand. In general, more complicated projects will have more unforeseen costs added on. For example, aerospace company Boeing says it’s unable to make money with fixed-price contracts. A large part of this is due to their Starliner program, and the high number of complex variables.

Lastly, large-scale projects can be tricky to manage under fixed-sum contracts. Large projects generally take more time to complete, increasing the odds that something goes wrong along the way. You’ll also be dealing with more materials; even slight miscalculations could end up costing you thousands.

What other contracts should I consider?

Sometimes, a fixed-price contract is just a bad idea. That’s the nature of doing business. In these instances, it’s better to consider another type of contract. Here are some examples:

- Guaranteed maximum price (GMP): as the name suggests, this contract stipulates a maximum price. It’s similar to fixed-cost contracts because there’s a set price from the beginning. However, completing a project under the maximum price doesn’t mean you’ll receive the rest as profit.

- Cost-plus: in cost-plus contracts, the buyer pays the contractor for project costs and a predetermined profit margin. For example, let’s say that a cost-plus contract stipulates a 15% profit margin and that the project took $250,000 worth of materials to build. This would mean the total contract cost would be $287,500 ($250,000 x 1.15 = $287,500).

- Time and materials: under time and materials contracts, the contractor bills for material costs and labor at an hourly rate. This is the most straightforward and traditional type of contract.

- Unit price: this one is a bit tricky. Unit price contracts divide labor into “units”, and assign a price to each unit. It’s generally used for projects that repeat the same thing over and over, like apartment buildings.

How do fixed-price contracts affect inventory management?

Let’s say you’ve decided to use a fixed-price contract for your next project. Operating under this type of contract introduces some challenges, mainly regarding materials, which is why proper inventory management is critical.

It’s important to reduce lead time as much as possible when sourcing materials, so having proper reorder points can be a lifesaver. Reorder points will ensure you have the necessary materials on hand when you need them while avoiding the costs associated with holding excess inventory. If you experience a delay in materials, you’ll risk prolonging your timeline, which will mean less profit. There’s also an opportunity cost to spending too long on a project, and the longer it takes, the more you’ll miss out.

Other important factors are budgeting and material sourcing. These two go hand-in-hand, as the budget is what allows contractors to purchase materials in the first place. Many contractors will buy the materials all at once to make budgeting easier. If prices go down soon after, there will be some profit loss, but it’s often better to plan ahead, mainly because the inverse is also true. Material prices can rise as quickly as they fall, leading to even greater profit loss.

Understanding your projected project costs is all about analyzing your historical data. Businesses can use the information they have from past projects to help inform their decisions on future projects.

Implementing fixed-sum contracts successfully

No contract is perfect; learning what works for your business can involve trial and error. However, you can mitigate early growing pains by adopting best practices early on.

It’s important to remember that, under fixed-price contracts, the contractors assume all of the risk. It’s up to them to budget things accordingly to deliver on time while also making a profit. Deciding whether a fixed-price contract makes sense requires intimate operations knowledge. It is crucial to have a concise understanding of how quickly you can finish the project and how many materials it will take.

Similarly, accounting for market shifts is vital, especially if you purchase materials in batches. Not accounting for price shifts and material availability are some of the most common reasons contractors lose money.

The best way to remedy most of these challenges is to use field service management software, like inFlow. We developed our software to be the perfect companion for businesses using all different types of contracts. Our reorder point notifications make staying on top of your stock levels easy. We have all kinds of reporting features, allowing you to look at material costs on past projects quickly. Our built-in barcoding feature will help automate your most tedious and time-consuming tasks. And if you’re in the US and Canada, inFlow can even take payments online.

So, no matter what type of contract your business uses, inFlow is here to help.

0 Comments