All too often we hear that companies must chase down their clients in order to get paid. Your company will have overhead whether or not your client has settled their 10,000 debt. In the case of small businesses this can be detrimental not only to the business’ cash flow but also to their efficiency as multiple employees become involved in the collection process.

So how to toe the line between benevolent but cash-poor, and belligerent but with sufficient cash flow? Partly it’s having a good handle on what is coming in and what’s going out at any given moment. This is tricky and many larger companies have an individual responsible for ensuring strong cash flow. But for smaller shops the key is turning on the charm and being smart about how you collect your fees.

Plan Ahead

Hannah Seligson of The New York Times suggests that the key to successfully bringing your accounts up to date is ensuring that you plan ahead. Only take on clients that have been thoroughly vetted. Even if a potential client has a big business proposition for you, it’s important to remember that if they have a poor credit history you may end up with all the burdens and none of the reward. Similarly, if you know that a particular client has a history of paying late; it may make sense to negotiate a shorter payment term for that client.

This will ensure that even if they’re late with their payment, you can take this into account and plan your own expenditures accordingly. The most effective way of maximizing your receivables, it seems, is putting yourself in a position which does not compromise your ability to pay your own bills. By planning ahead to avoid this situation, you reduce the risk that your company will have to start making collection calls. This is a key point, as many a promising business relationship has been broken on the basis of delayed or non-payment so it’s important to address these issues respectfully and head on, at the beginning of the relationship.

Work out a process that works for you

So what to do when a client is refusing to pay? Emily Ross (SmartCompany.com.au) suggests coming up with specific practices which work for your company. “Co-founder of Emma & Tom’s, Tom Griffith, has built a system where he collects payments as he makes deliveries,” she notes. In this way, Griffith is avoiding stall tactics like the classic ‘invoice lost in the mail’, which can be used to forgo payment. It is also much harder to refuse payment if your vendor is standing in your lobby, and implies that if payment is refused he will take your order with him. While this method won’t work for everyone, the process Griffith has developed maintains efficiency by rolling the collections into a task that is already being done. When coming up with your own strategy it is important to remember this strategy. It is also important to remember that the other company has the same issues that you do and sometimes active listening can help you determine if they are unable to pay you or are just being stubborn. If it’s a matter of inability sometimes stretching out the payments over time can help:

[C]lients would get halfway through a project and stall because they could not afford the next 33% payment for the project. Leyshan worked out that changing the payment terms to be equally spread over six months worked well. Less upfront for Leyshan but easier for the clients.

“The clients thought they were getting special treatment over and above standard payment terms, it also levelled our lumpy cashflow and in some instances the project was paid for in full months before completion,” he says. (Ross)

Keep a close eye

And if all else fails, giving a discount if the full amount is paid upfront can be a good incentive, especially if you suspect the client has no intention to pay you. Getting some of the money you’re owed is better than not receiving any payment at all. However this tactic should only be used as a last resort, and only with clients you intend to cut ties with. Conversely, the same strategy can be used to encourage timely payment by offering discounts to clients who pay on time, 10% as an example for clients who wish to pay before the invoice comes due. Either way it is important to set clear expectations and to have a plan in place for collection. Experts also suggest chasing the debts early as the longer a debt festers the less likely the client is to pay it. This can also help when you don’t have an active business relationship with the client, reducing their incentive to pay on time. With that in mind it is important to know when a business relationship should be extinguished. Keeping a close eye on the credit extended to a client can allow you to periodically put a client’s credit on hold without causing a huge blowout and completely severing the relationship. This is another key component to the planning stages, which is to say that caveats such as a credit limits will give you a little more wiggle room.

Ultimately it will be important to work out what process is best for your company and your industry but no matter your business these tips and tricks from industry leaders can be very helpful. After all, having a strong cash flow can only benefit your business..

A few more tips of the trade:

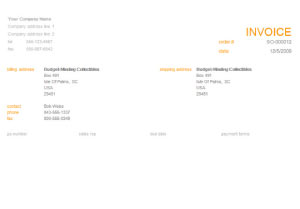

-Make sure that your invoices are PERFECT before they go out. It takes very little for a company to start stalling the payment process

-Offer to pick up the payment yourself, if the client understands that it’s important they may be more willing to get things moving

-Make sure that you set expectations early and get it in writing. The more clear cut things are the less opportunity there is for misunderstandings and unnecessary upset.

-Learn to be firm but polite. If you get upset with a customer because they’re a day late, they may decide they don’t want to do business with you going forward.

Resources

Seligson, Hannah. “Learn How to Collect From Slow Payers.” Nytimes.com. April 6, 2011. April 12, 2011. <https://www.nytimes.com/2011/04/07/business/smallbusiness/07sbiz.html?_r=1&partner=rss&emc=rss>

Found your site on yahoo today and really liked it.. I bookmarked it and will be back to check it out some more later.