Key takeaways

- A tariff is a tax imposed by a government on goods imported into their country. Understanding how tariffs work is essential for comprehending international trade policies.

- The purpose of tariffs is to stimulate the local economy by encouraging consumers to buy locally.

- While tariffs are imposed on businesses, the additional costs associated with them are typically passed down to the consumer through price hikes, making all imported goods more expensive.

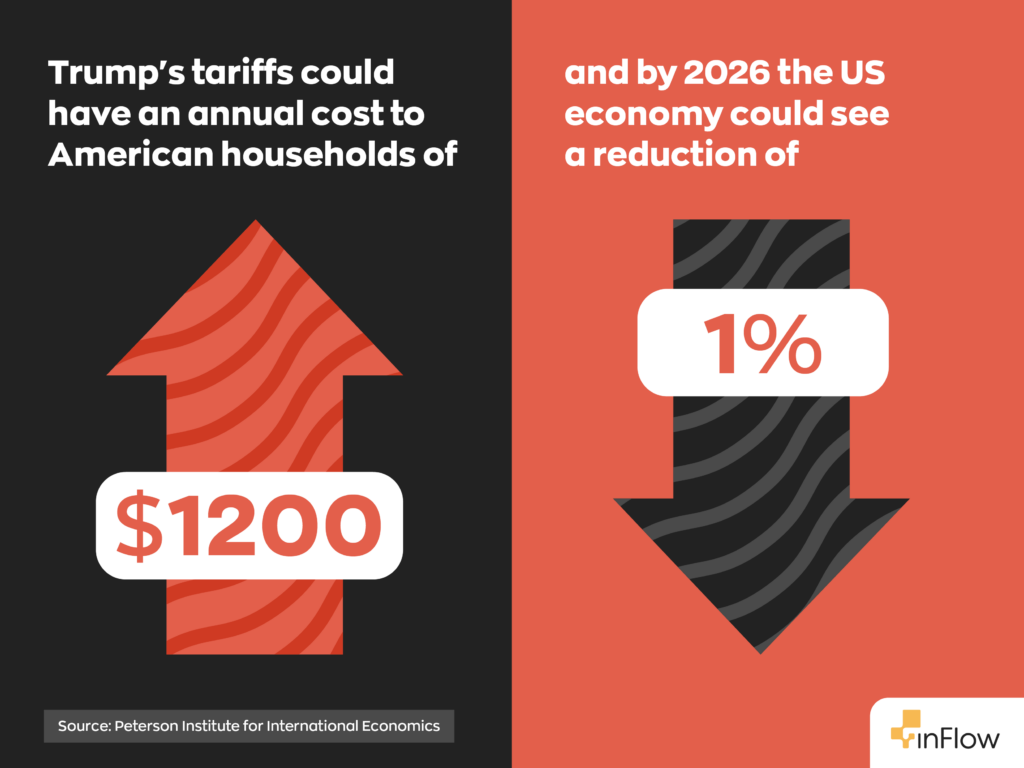

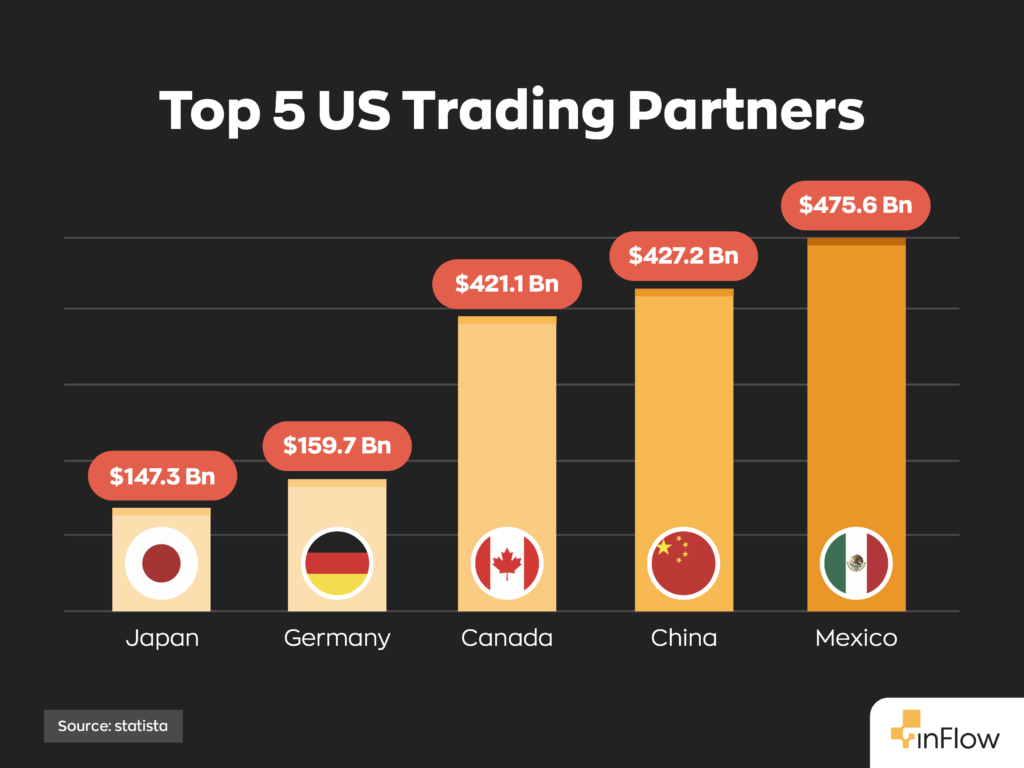

- The Trump Administration intends to place a 25% tariff on goods imported from Mexico and Canada and a lower 10% tariff on energy resources.

- Supply chains will likely see substantial changes when the tariffs go into effect.

- To mitigate the impacts of tariffs, companies should consider stockpiling inventory, reassessing supply chains, and exploring ways to reduce operating costs.

Politics is a tricky subject and one we tend to avoid around here. But regardless of your political beliefs, Donald Trump, the new President of the United States, has taken office and plans to shake things up worldwide for businesses. In fact, he’s already gone to work, levying a 25% tariff on all trade from Mexico and Canada, with a lower 10% tariff on energy resources. This announcement has many businesses worried.

This tariff was initially planned to take effect at the beginning of February but was postponed, giving time for more negotiations. But as of March 4, they have officially begun. With the Trump Trade War kicking off, businesses in North America are scrambling to determine what this means for their operations’ future.

Today, we’ll go over how tariffs work, who pays tariffs, and what they mean for your business. So, if you’re looking to protect your business from the possibility of tariffs in the future, you’ve come to the right place.

What is a tariff?

A tariff is a tax imposed by a government on imported goods and services. Some tariffs are ad valorem (a percentage of the product’s value), while others are specific (a fixed fee per unit). Governments often impose these taxes on particular imports. For example, President Trump recently announced a 25% tariff on all steel and aluminum imports coming into the US. This means any country that sells steel or aluminum to the US will be subject to this 25% tax.

In addition, tariffs can stack. For instance, the steel tariff would be on top of the 25% tariff announced on all goods from Canada and Mexico. This would mean that steel and aluminum imported to the US from either Canada or Mexico would be subject to a 50% tax.

How do tariffs work?

As mentioned above, tariffs are taxes on products imported from other countries. If your business operates in Canada and sends products to customers in the US, you would be subject to these trade tariffs. The revenue from these tariffs would go directly to the government to help fund infrastructure, military spending, etc.

Tariffs are usually valorem, a percentage of a product’s value, such as 25%. However, certain products may have a specific tariff (fixed price). Sometimes, a government implements exceptions to help protect certain businesses. For example, a tariff may have a loophole that excludes orders under a specific dollar amount.

What is the goal of a tariff?

Governments typically use tariffs to protect domestic industries by making foreign products more expensive. The idea behind this is that, in theory, tariffs encourage industries to purchase and manufacture products locally.

However, according to the White House, these new tariffs on Canada and Mexico are related to border security, particularly stopping the flow of illegal immigrants and fentanyl. It’s worth mentioning that many politically savvy individuals aren’t buying this reasoning. Instead, they believe the President is merely using this as an excuse to declare a state of emergency. A national security threat allows the sitting president to impose tariffs without direct congressional approval.

Trump has also called for Canada to become the 51st state to avoid these proposed tariffs, making these tariffs a form of economic warfare.

Who pays for tariffs?

It’s a common misconception that businesses pay for tariffs. While this is technically true, the reality is a bit different. Businesses operate with razor-thin margins, and every expense is accounted for when pricing their products. Therefore, the cost of tariffs is passed onto the consumer through price increases. This essentially means all goods from foreign countries will increase in price equivalent to the value of the tariff.

So, for instance, if you live in the US and purchase a product from Canada that was once $1000, you’ll now be paying $1250. Depending on a business’s gross profit margin, it may be possible to absorb some of these expenses but not all.

On the surface, a price increase may seem good for businesses. After all, it means more revenue. However, they will undoubtedly experience a decrease in sales as their customers look for locally sourced alternatives.

In short, everyone pays for tariffs in one way or another. That’s just how tariffs work.

Do tariffs work?

The short answer is no, not really. We know this because this is not the first time the United States has done this to its closest trading ally. In the late 19th century, the McKinley Administration made a similar push to make Canada part of the U.S. Their weapon of choice? A tariff.

However, the result was far from what they desired. Rather than weakening Canada to the point of annexation, the tariff pushed them to do more business with Britain. The effects have persisted long into the modern day, considering Britain is the United States’ main economic rival.

Another unforeseen effect was that many US manufacturers moved to Canada to avoid the tariffs altogether.

At the time, Canadian Minister of Trade and Commerce Mackenzie Bowell said, “Our neighbors are cutting off their noses to spite us.”

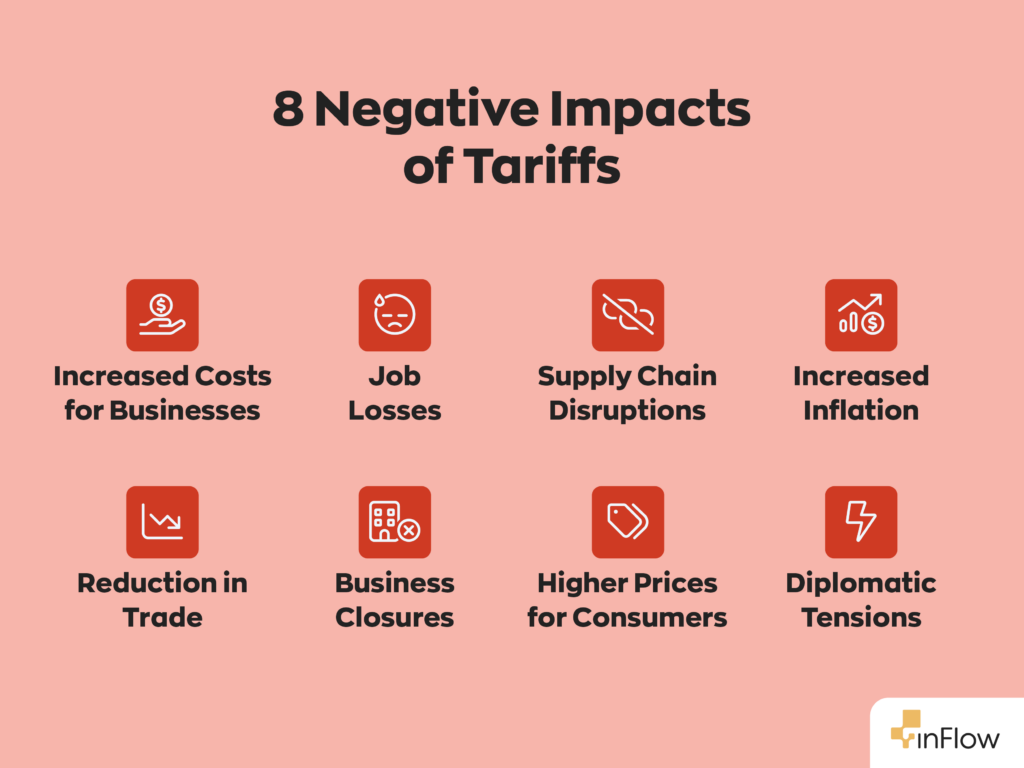

What other effects will tariffs have on businesses?

There’s no two ways about it: tariffs make things more complicated for businesses. Here are some effects that you’re likely to see.

Increased operating costs and prices

The increased costs caused by tariffs have a ripple effect throughout every industry. This is because tariffs affect not only the products themselves but also the raw materials. We mentioned that Trump plans to impose a 25% tariff on imported steel and aluminum. Both metals are crucial to the construction and manufacturing industries. So, even if a company manufactures its products in the US, it will likely source some of its materials from Canada or Mexico.

Check out this clip from our latest podcast episode, where we discuss tariffs and their impact on small businesses.

Supply chain disruptions

In the best of times, supply chains can run precariously, so it shouldn’t be surprising that tariffs threaten to break them. Previously robust supply lines may dry up, and many others may become completely unavailable.

Retaliation

Retaliation in this context means governments implementing retaliatory tariffs or legislation to get back at one another. A tit for tat, so to speak. Geopolitics can be messy; unfortunately, businesses get caught in the middle. When one government issues a tariff, other governments must respond in one way or another.

Reduction of imports

If importing goods to the US becomes less profitable, fewer companies will do it. That’s another basic tenant of business. If a business can make $2 selling in the US or $3 selling in Europe, they’re going to sell in Europe.

How can you prepare for tariffs?

Unfortunately, mitigating the effects of tariffs can prove challenging. Knowing how tariffs work doesn’t mean you can avoid them. It’s a federal-level mandate, after all. Still, there are some steps you can take to prepare. Here are some that we think you should consider:

- Stockpile ahead of time—Under normal circumstances, we wouldn’t advocate carrying excess inventory. However, desperate times call for desperate measures. Ordering as much as possible before tariffs take effect may be a smart move—at least for the short term.

- Assess supply lines—The upcoming tariffs will likely challenge supply lines worldwide, so it’s a good idea to check up on yours. Some may rely on US or Canadian infrastructure, and whether that will remain after the tariffs is a bit of a toss-up.

- Explore alternative sources—As the costs of certain vendors rise, it’s essential to check for alternatives. While some suppliers may increase their prices, others may stop servicing your area altogether.

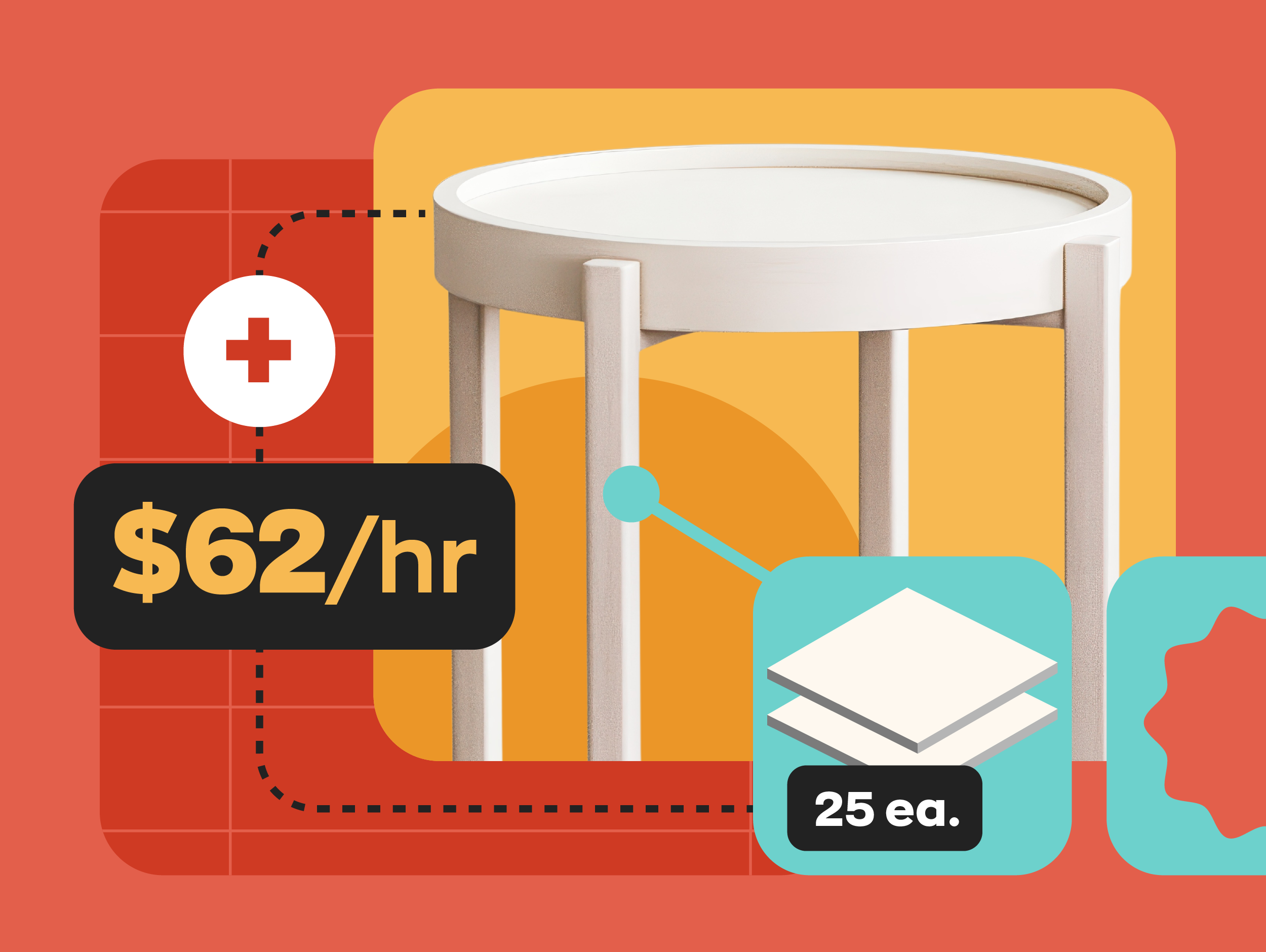

- Reduce costs in other areas—A great way to mitigate the impact of tariffs is to cut costs wherever possible. One easy way to do this is to use software to streamline your processes. For example, if you implement inventory software, like inFlow, you can automate various tasks, saving time and money.

Conclusion

Now you know how tariffs work, you would probably agree that they aren’t great for anyone. If this trade war continues too long, consumers and businesses will feel the pain. We’re not trying to be the bringers of doom and gloom, but tariffs damage the global economy. That’s just the reality.

If I attribute the images may I use your Tariff images in my company’s blog?

Hey Margi,

Thanks for reading. Please feel free to use the images from this post so long as you attribute them and provide a backlink to this article.

Cheers,

Jared