Key takeaways

- A wholesale license allows businesses to purchase products in bulk without paying sales tax.

- It is not always required to have a wholesale license. Some jurisdictions only require wholesalers to have a reseller’s permit when selling to businesses (B2B).

- While not always a requirement, obtaining a wholesale license fosters trust and adds legitimacy to your business.

- A seller’s permit is also required if your wholesale business plans to sell directly to consumers (B2C).

- To apply for a wholesale license, you’ll need to submit a variety of information about your business. Generally speaking, the process is simple.

- Legislation surrounding wholesale licenses differs based on your location. Be sure to check your local legislation beforehand.

Not all businesses that sell physical products fall into the same category. For example, you’ve got retailers, wholesalers, distributors, and other business models like dropshipping. But in most cases, regardless of your business model, you’ll need a license of some sort before getting started. Otherwise, you may find yourself in legal trouble.

Today, we’ll focus on wholesale in particular. We’ll go over how to get a wholesale license, why you need one, and what benefits it brings. So, if you’re thinking about how to sell wholesale, this article is a must-read.

What is a wholesale license?

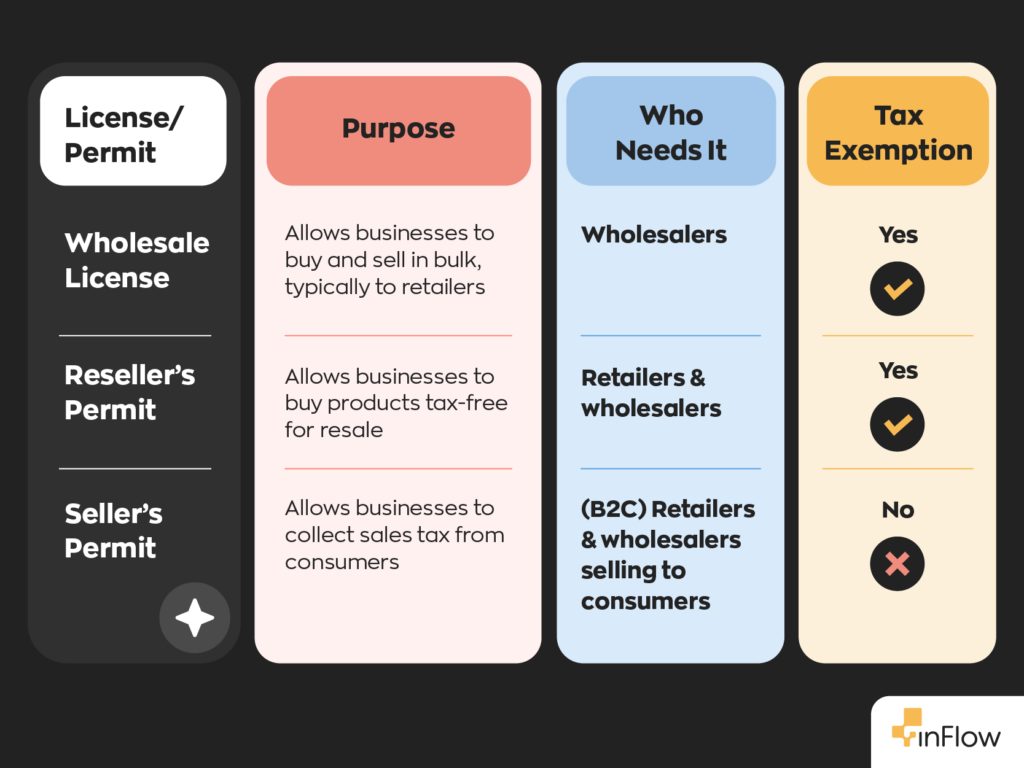

A wholesale license is a legal document that allows individuals and/or businesses to buy products in bulk directly from manufacturers or distributors without paying sales tax. In some areas, a wholesale license is required if you intend to sell goods to other businesses rather than consumers. However, wholesalers can operate in many places using a reseller’s permit or sales tax exemption certificate.

Why do you need a wholesale license?

While it’s true that you don’t always need a wholesale license, these situations are typically the exception rather than the norm. That’s why knowing how to get a wholesale license is so important.

Even if it’s not always a requirement, having a wholesale license has some great benefits. Most notably, US businesses with a wholesale license are exempt from sales tax at the time of purchase. This is because the consumer will ultimately pay the sales tax when making the final purchase through the retailer.

A less tangible benefit of having a wholesale license is that it’s a sign of trust. Sometimes, just having a business license isn’t enough. Manufacturers are more likely to trust someone with a wholesale license and may also be more open to negotiations with wholesalers who hold one. Ultimately, it adds an extra level of legitimacy to your business.

How is it different from a reselling permit?

We briefly mentioned reseller’s permits above. These allow retailers to purchase goods tax-free from wholesalers. Although this sounds similar, the key difference is their intent with those products. Retailers specifically aim to sell to consumers, while wholesalers typically sell to other businesses.

Although the two serve similar purposes, they’re split into two different documents. However, depending on your location, these two permits might be bundled together. Always double-check your local rules and regulations to determine what’s required in your area.

What about seller’s permits?

Another important permit to mention is a seller’s permit. This permit allows businesses to collect sales tax legally when selling their products. It’s an essential part of any business that sells products directly to the consumer (B2C).

Wholesalers who are only doing business with other businesses (B2B) don’t need to worry about a seller’s permit since they won’t be collecting or paying sales tax. However, if you plan on selling both B2B and B2C, you will need a wholesale license and a seller’s permit.

How to apply for a wholesale license

Now that you know why you need a wholesale license, you need to know how to obtain one. Some of these steps will differ from place to place, but the basic outline remains the same. Still, it’s best to look into your local legislation beforehand. Organizations exist specifically to help businesses obtain their licenses.

Step 1: Register your business

First things first, you’ll need to make your business legitimate. This means you’ll need to register your business, obtain a business registration, and choose a legal classification for that business. In this instance, “legal classification” means sole proprietorship, limited liability company (LLC), and so on.

Step 2: Obtain an employer identification number (EIN)

Even if you’re a one-person show, you’ll need an EIN. This also functions as your business’ tax number and is what you’ll use to open bank accounts and file taxes. To apply for an EIN, you’ll need to go to the IRS website and supply a variety of information. This includes your social security number, business address, and business name.

Generally speaking, this process is relatively easy and not time-consuming.

Step 3: Obtain a seller’s permit (if applicable)

Remember the seller’s permit we mentioned above? Well, if you plan to sell wholesale and directly to consumers, this would be the time to get a seller’s permit. The specific requirements to obtain a seller’s permit will differ based on location, so make sure to check ahead of time.

Step 4: Gather the relevant information and apply

Before applying, you’ll need to put some information together. Most of it should be easily obtainable. A non-exhaustive list is as follows:

- Business name

- Owner’s name

- Taxpayer ID

- Business address

- Contact information

- Nature of the business

- Seller’s permit (if applicable)

- General business license

- Employer identification number (EIN)

From here, you’ll submit an application to your local jurisdiction. We’ve said it a few times, but local legislation tends to differ based on where your business operates.

Additionally, applying for a wholesale license usually involves fees. These amounts can vary wildly depending on where you apply. For example, Alaska requires a bi-annual fee of $2,00 to maintain the license. On the other hand, Texas doesn’t require a wholesale license at all.

Different industries may have different requirements

It’s also important to keep in mind that different industries may have different regulations. For example, a wholesaler carrying bulk hazardous chemicals will likely be subject to stricter regulations and require more certifications and licenses than a fashion company.

Knowing how to get a wholesale license is just the first step. You’ll also need to know the legislation surrounding the rest of your business and where to go next.

Software that will help you succeed as a wholesaler

Whether it’s a wholesale license, reseller’s permit, or seller’s permit, obtaining the proper legal documentation is key to ensuring compliance with local regulations. This will keep your operation running smoothly from day one.

However, having the proper legal documentation is just the beginning of running a thriving wholesale business. How you manage your day-to-day operations is what truly determines your success.

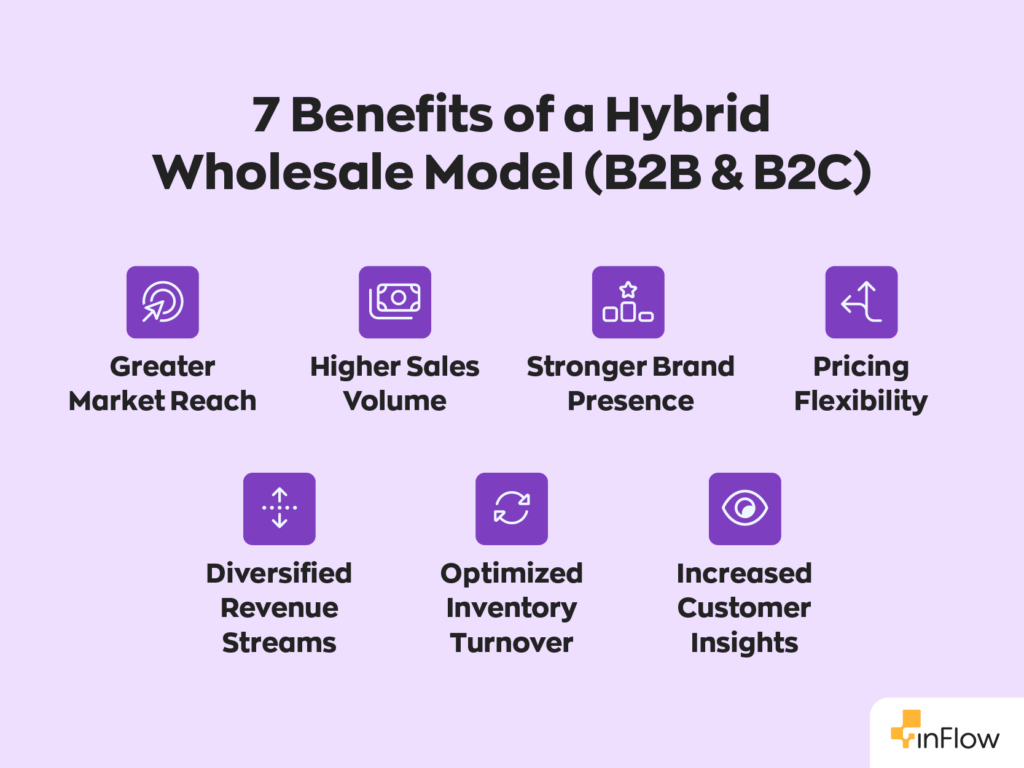

That’s where inFlow’s wholesale software comes in. Our all-in-one inventory and order management software helps wholesalers track stock levels, process bulk orders, and manage sales across multiple sales channels with flexible pricing schemes. That means you can easily sell both B2B and B2C seamlessly. With inFlow, you can also:

- Generate and track purchase and sales orders.

- Create, print, and scan barcodes with our built-in barcoding system.

- Automatically apply special tax rates for customers with exemptions.

- Integrate with ecommerce and accounting tools such as Faire, Shopify, QuickBooks Online, and Xero.

- Create a private inFlow Showroom sales portal to display selected products and pricing for clients.

With inFlow, you’ll be ready to take your wholesale business to the next level. So what are you waiting for? See for yourself and give inFlow a try today!

0 Comments