Key takeaways

- Proper inventory accounting involves tracking all materials, including raw materials, work-in-progress, and finished goods.

- Inventory accounting aims to ensure that all financial records are accurate and up to date.

- Which inventory costing method you choose will have a major impact on your inventory accounting.

- The three most popular inventory costing methods are first-in-first-out (FIFO), last-in-last-out (LIFO), and moving average.

- Another key metric involved with inventory accounting is cost of goods sold (COGS).

- COGS helps businesses determine the direct costs associated with producing or purchasing the goods they sell.

- Some inventory accounting best practices include cycle counts, adopting inventory software, and standardizing processes.

Accounting for your inventory can be tricky! You have to be sure to include your raw materials, work in progress, as well as the finished goods that you have on site. Your inventory is considered a business asset, so whoever does your accounting will need accurate valuations to avoid issues on your balance sheet.

Today, we’ll focus on everything related to inventory accounting, including costing methods, cost of goods sold (COGS), and more. So, let’s put on our bookkeeping hats and get started!

What is inventory accounting?

Simply put, inventory accounting is the process of tracking, managing, and adding value to your inventory to ensure accurate financial records. For proper inventory accounting, you’ll need to consider things like costing methods and COGS. These metrics are pivotal for your accountant when calculating numbers like the markup on your products.

Your inventory also directly correlates to your income earned (and therefore income tax) since you document the inventory you sell as an expense. Effective inventory accounting helps businesses:

- Maintain accurate financial records.

- Calculate taxes.

- Determine profit margins.

- Avoid stockouts or excess inventory.

- Make informed procurement decisions.

How do inventory costing methods impact accounting?

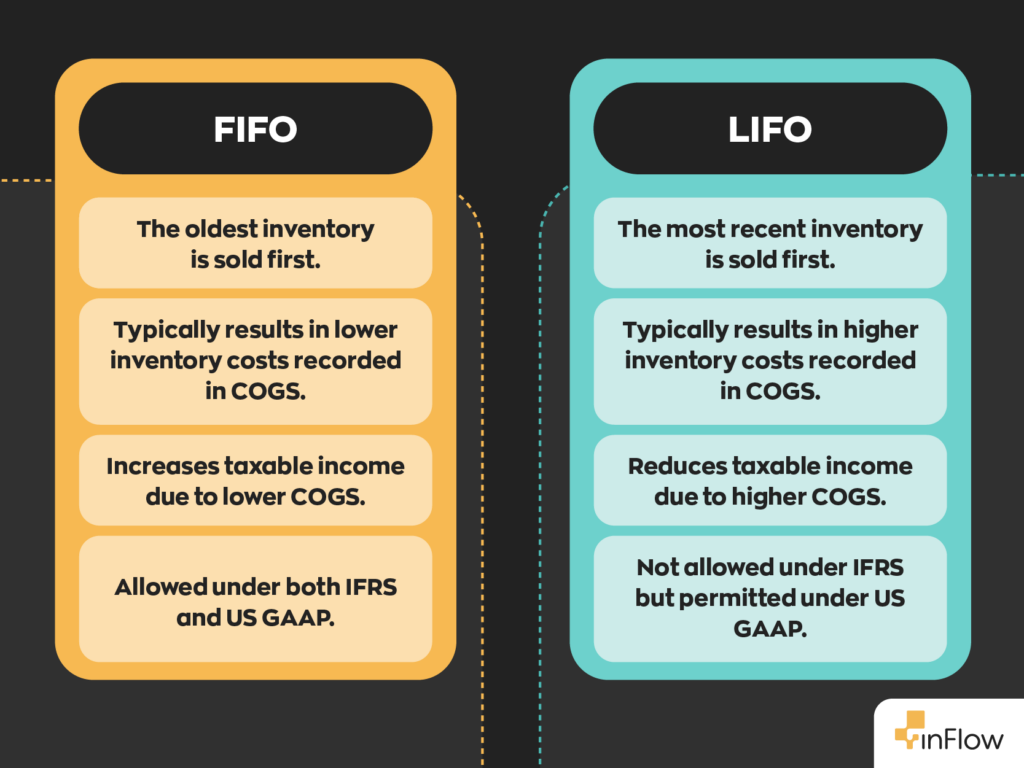

Which inventory costing method you choose will significantly impact your financial statements and tax obligations. Businesses can choose from several inventory costing methods, the most common being first-in-first-out (FIFO). Other methods include last-in-first-out (LIFO), weighted average cost, and the specific identification method. Let’s take a closer look at each and how they will impact your inventory accounting.

First-in-first-out (FIFO)

The FIFO method assumes you always sell the oldest items in your inventory first. Essentially, you sell your products in the order you procure them, hence the name first-in-first-out. Most companies use FIFO for their inventory accounting, which usually offers lower COGS and higher profits. However, this costing method also may increase tax liabilities.

Example: Let’s say we own a furniture store and buy 25 office chairs for $25 each. A month later, we purchased 25 more office chairs, but this time for $30 each. We then receive an order for 30 office chairs for $1800. Using the FIFO inventory costing method, we would first use the 25 office chairs worth $25 each, and the remaining 5 chairs would come from the shipment that cost $30 each. This would bring the total cost of the chairs to $775, with a profit margin of $1025.

Last-in-last-out (LIFO)

With the name last-in-first-out, I’m sure you may be able to guess how LIFO works. In the LIFO method, you assume that the items bought last are the ones that are sold first. This inventory costing method doesn’t typically follow the natural flow of inventory but can be advantageous in times of inflation, as it leads to higher COGS and lower taxable income.

Example: To return to the example above, let’s say our business uses LIFO instead of FIFO. In that case, we would first take the 25 chairs from the $30 shipment and then the last 5 from the $25 shipment. This would bring the total cost of the chairs to $875, with a profit margin of $925.

It’s important to note that the International Financial Reporting Standards (IFRS) has banned this costing method.

Moving average costing

Moving average costing recalculates the average cost of each inventory item in stock after every purchase. The calculation takes the total cost of the purchased items divided by the number of items in stock. This costing method is effective at smoothing out price fluctuations and providing a balanced approach to inventory valuation.

Example: Using the above example, let’s examine how moving average costing impacts inventory accounting. First, we would divide the total cost for both shipments by the number of chairs purchased. This would give us a moving average of $27.50, meaning the total cost of the chairs is $825, with a profit margin of $975.

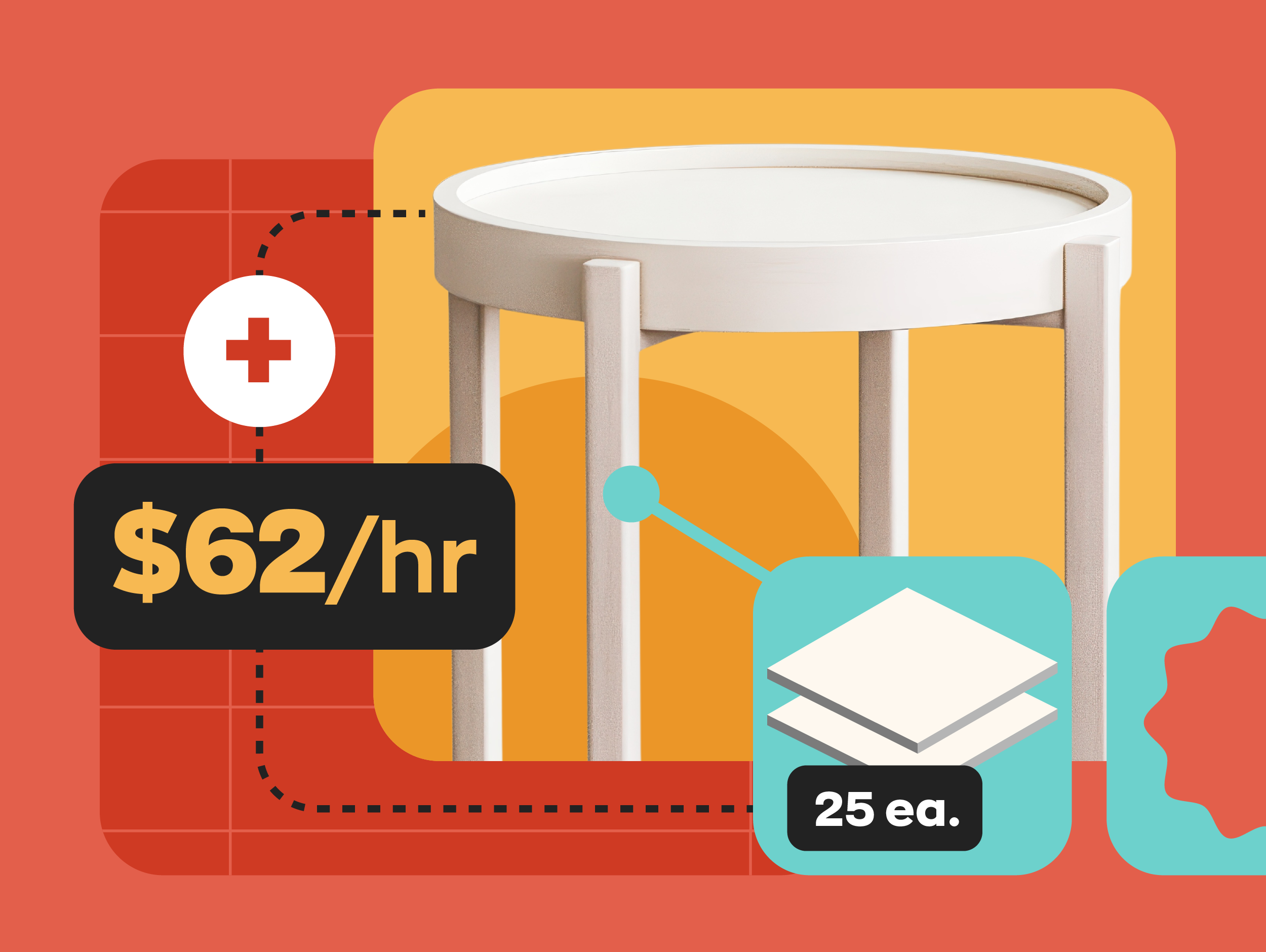

Specific identification method

This method keeps the cost of each and every item you have in your inventory. It’s typically only used for very high-cost and unique items such as cars or rare diamonds.

Example: Let’s say our furniture store also sells rare hand-crafted mahogany tables. Over a few months, we purchased 6 tables at various prices. For the first table, we paid $1000, then $1100, then $1200, and so on. We then sold 3 of those tables for $5000, to which we gave them the first 3 tables we purchased. Thus, the total cost of the tables is $3300, with a profit margin of $1700.

Why COGS is important to inventory accounting

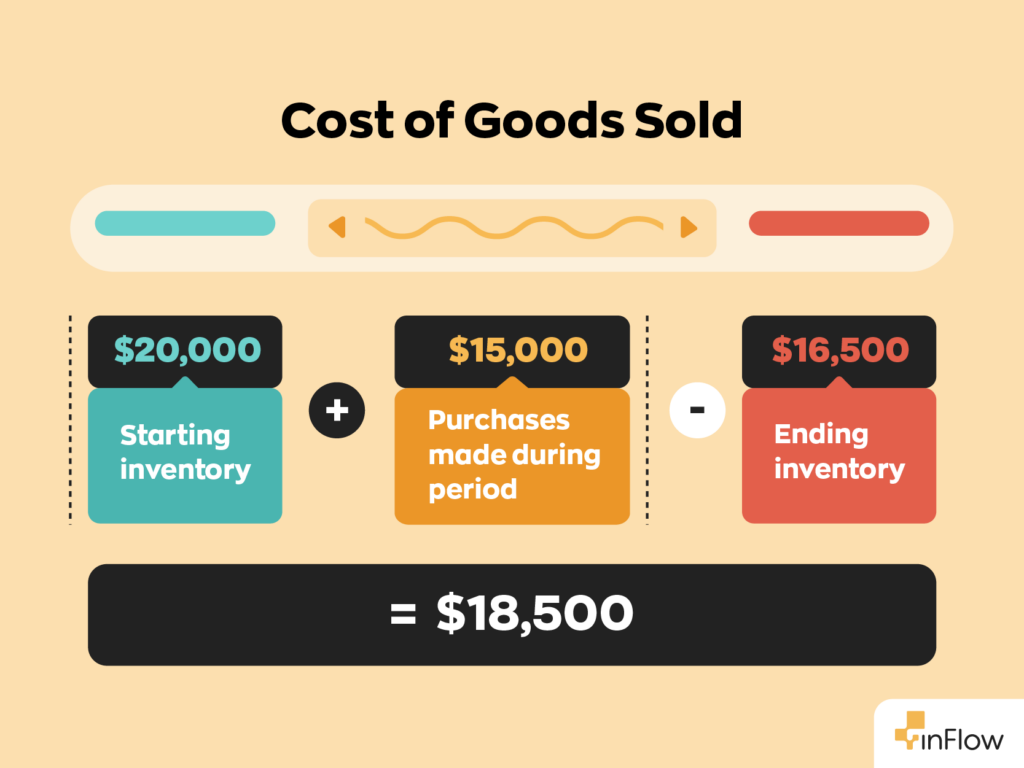

Your cost of goods sold (COGS) is basically the cost of the items you sold over a time period. It affects taxation as businesses can deduct their COGS from revenue to lower their taxable income. Cost of goods sold also helps businesses evaluate their overall profitability and pricing strategies. The formula for COGS looks like this:

Breaking the formula down piece by piece, here’s what we get:

- Starting inventory—This represents the value of inventory a business has at the start of an accounting period, including any unsold items carried over from the previous period.

- Purchases—This represents the total cost of all inventory items during the accounting period. It may include expenses related to acquiring the inventory, such as shipping, taxes, and handling fees.

- Ending inventory—This represents the value of any unsold inventory during the accounting period.

Example: To return to our furniture store example, let’s examine the cost of goods sold for the office chairs we mentioned. We started our accounting period with 50 office chairs, with a total cost of $1375. We spent $300 on shipping and other fees related to that inventory. After the accounting period, we sold 30 of our 50 office chairs. For this example, let’s assume we’re using the moving average costing method, which means the chairs cost $27.50 each. Therefore, our COGS would be:

($1375 + $300) – $550 = $1125

As the above example shows, the inventory costing method you choose will impact your COGS and, ultimately, your inventory accounting.

Inventory accounting best practices

Everything mentioned above are just some of the many things you’ll need to consider when accounting for inventory. We get it. It can be pretty overwhelming, but we have some tips and tricks to help you keep your head above water:

- Use inventory management software—You don’t use spreadsheets or a pen and paper when managing your inventory for the same reason you don’t use an abacus for arithmetic. Software solutions like inFlow have features that make inventory accounting a breeze.

- Perform regular audits—Cycle counts are a pain. They’re time-consuming and sometimes require you to pause your business operations completely. However, we can’t stress enough how vital they are for accurate inventory accounting.

- Monitor stock levels—When you order excess inventory, you will run into all kinds of complications when it comes to your accounting. Monitoring your stock levels as closely as possible can help prevent this.

- Standardize procedures—Standardization is valuable in all aspects of business, including inventory accounting. Establish clear policies for accounting, inventory tracking, purchasing, and valuation.

- Leverage reports—If you’re using inventory software, chances are you’ll have loads of reports you can generate with just a few clicks. Take advantage of them!

Simplify your inventory accounting with inFlow

Accounting for inventory doesn’t have to be a headache. Like anything else in the modern day, you can always leverage software to make your life easier. Our software inFlow is perfect for anyone looking to automate their inventory accounting. For example, you can choose from a number of different costing methods for your products, such as LIFO, FIFO, and moving average. From there, inFlow can automatically calculate your COGS—no need for a formula.

inFlow also integrates seamlessly with QuickBooks Online and Xero, offering a two-way payment sync option. This makes it easy to synchronize inventory data with accounting records and ensures that financial statements remain accurate.

Additionally, inFlow offers robust reporting features that will give you insights into your cost of goods sold (COGS), inventory movements, and profitability.

By leveraging inFlow, your business will gain comprehensive inventory and accounting features that you can use to improve your financial health.

0 Comments