Key takeaways

- Inventory shrinkage is the loss of stock due to factors like errors in inventory management, damage, or theft.

- High inventory shrink will increase the cost of goods sold (COGS) and decrease profit margins.

- Poor inventory management techniques, human error, and theft are the most significant contributors to inventory shrinkage.

- It’s almost impossible to eliminate inventory shrinkage, but there are ways to reduce it.

Running a business comes with plenty of challenges. You’ll need to balance customer demand, manage cash flow, and stay ahead of competitors, to name just a few. On top of these everyday pressures, inventory management presents its own hurdles. Business owners must ensure they have the right products available at the right time while avoiding stockouts and overstock. But even the best-laid inventory plans can be undermined by an often-overlooked issue: inventory shrinkage.

This is a common yet costly issue faced by businesses of all sizes, and unfortunately, no one can avoid it entirely. But what is inventory shrinkage? How does it affect your business? And, most importantly, how do you combat it?

What is inventory shrinkage?

Inventory shrinkage is an umbrella term that businesses use to refer to inventory losses that were not part of sales. For example, let’s say that a business has 200 product units. Out of those 200 units, they sell 180 but then fail to find the other twenty. That’s inventory shrinkage in a nutshell. It’s missing inventory that a business purchased but can’t sell for various reasons, which we’ll go into more detail later.

How to calculate inventory shrinkage

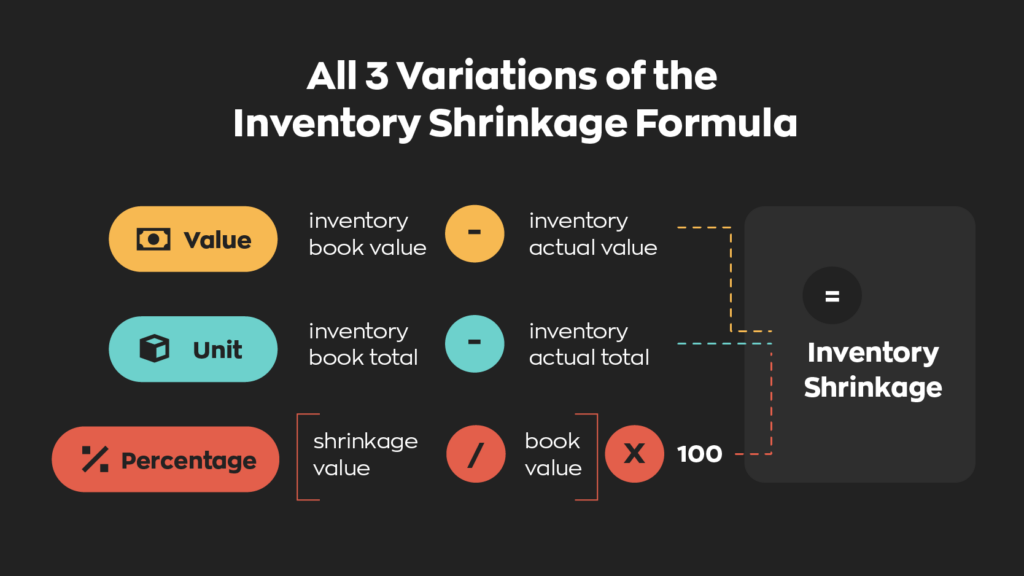

You can calculate inventory as a value, a unit figure, or a percentage. Fortunately, the formulas to calculate inventory shrink are pretty simple. We’ll use our example from above for the sake of these equations.

Value

The equation to calculate shrinkage as a monetary value is as follows:

Inventory shrinkage = inventory book value – inventory actual value

For the sake of this example, we’ll assign a unit value of $5. That means the inventory book value is $1000, and the actual value is $900. When we say actual value, we mean the actual realized gain you received from selling the items. Plugging those into the equation, we get the following.

Inventory shrinkage = $1000 – $900

Inventory shrinkage = $100

Therefore, the business lost $100 worth of items due to inventory shrinkage.

Unit

You can use the same equation to calculate unit shrinkage. Just substitute value with units. Here’s what that looks like:

Inventory shrinkage =inventory book total – inventory actual total

And we already have these figures; 200 and 180 respectively.

Inventory shrinkage= 200 – 180

Inventory shrinkage = 20

Therefore, the business lost 20 units due to inventory shrinkage.

Percentage

Calculating the percentage of inventory shrinkage is a bit more complicated. Instead of calculating the percentage of units missing from the whole, you’ll calculate the total value missing. This gives a more accurate picture of how much inventory shrinkage costs a business. Here’s what the equation looks like.

Inventory shrinkage = (shrinkage value / book value) x 100

We’ll reuse the value figures here, just in a different order.

Inventory shrinkage = $100 / $1000 x 100

We can remove the dollar sign without consequence here.

Inventory shrinkage =0.1 x 100

Inventory shrinkage = 10%

Pretty simple. Right? Unfortunately, despite that simplicity, inventory shrinkage has major implications for affected businesses.

How does inventory shrink affect businesses?

Inventory shrinkage is pretty much always a net negative for businesses. There are some peripheral cases– like with charity– where they may be overall neutral, but those are exceptions, not the norm. Aside from the obvious monetary loss that comes with inventory shrinkage, there are other impacts on your business. Here are some of the major ones.

Increases COGS

Generally speaking, businesses purchase products in bulk. It decreases the cost per unit, in turn lowering the cost of goods sold (COGS). Inventory shrinking effectively increases the cost per unit, which in turn increases the COGS.

Incur additional costs

Missing inventory means ordering replacements. Some businesses might forgo replacing missing products, but they’re still losing money at the end of the day. With that said, inventory forecasts are becoming more and more precise, which means even a few missing units may result in missed sales opportunities.

Price increases

Increasing your prices is one way to offset the impact inventory shrinkage has on your business. Of course, the obvious downside is that customers may look elsewhere. Since inventory shrink is pretty much a guarantee for any business, it should be priced into your unit cost. This way, you can avoid having to raise prices unexpectedly.

Loss of brand loyalty

Inventory shrinkage causes revenue loss in other ways than the monetary loss of physical products. Not having a specific product available will not only mean your customers will look elsewhere but also hurt your brand loyalty.

Common causes of inventory shrinkage

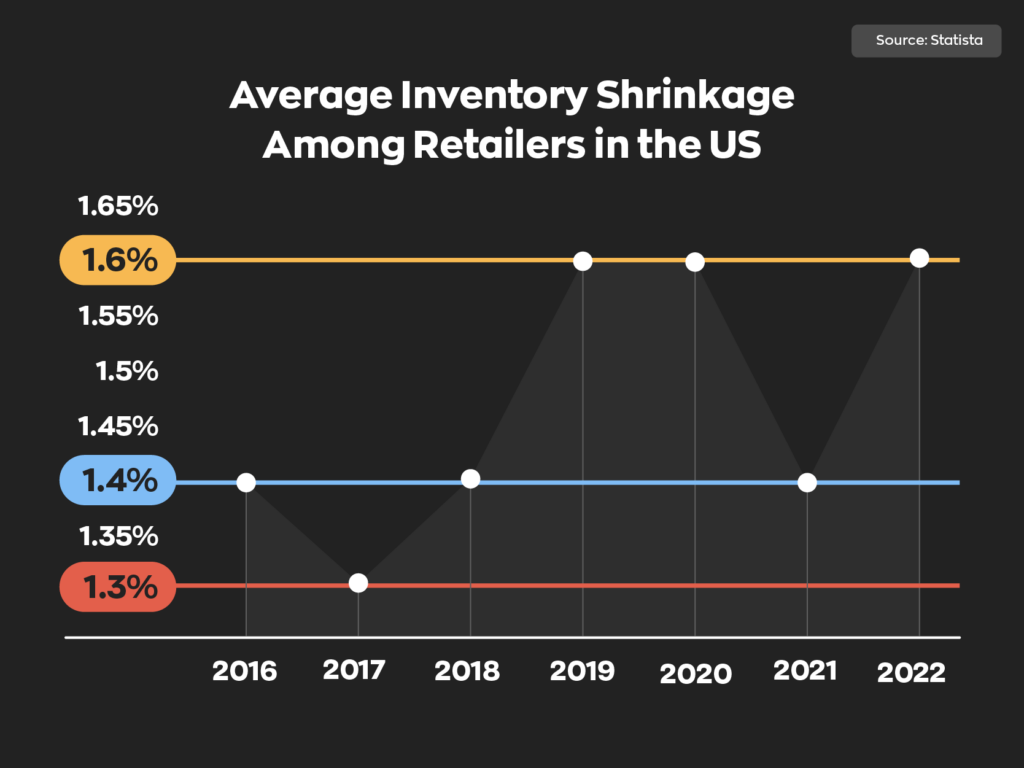

Many things can lead to inventory shrink. Some of them are relatively benign, while others involve outright crimes. Something to note here is that the average inventory shrinkage for US retailers has been increasing by 1.6% in 2022. That 1.6% might seem small in the grand scheme of things, but it equates to nearly $100 billion in lost revenue.

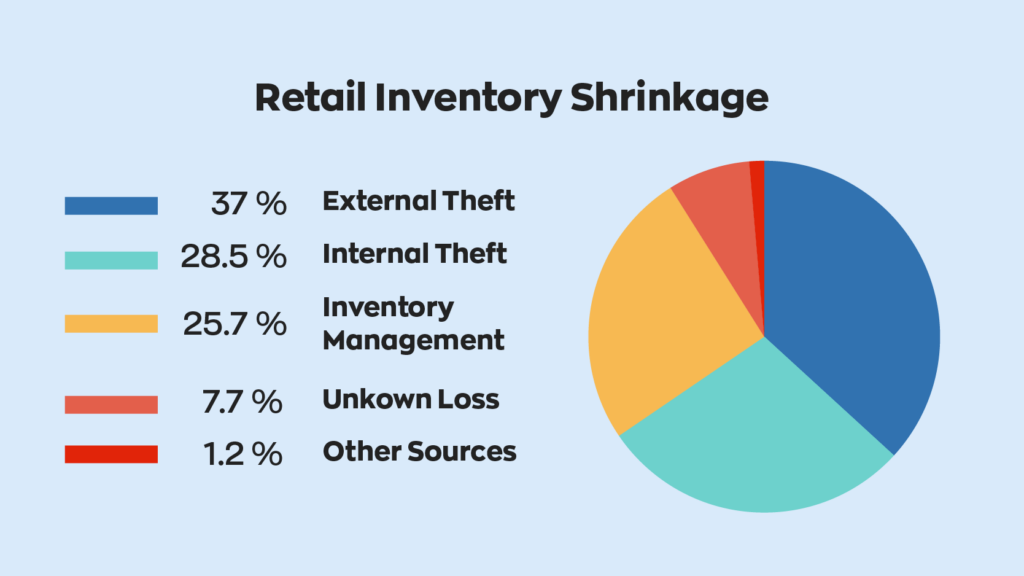

Theft

Shoplifting and organized crime make up a large portion of inventory shrinkage for retailers. Employee theft is also common, but it’s crucial not to make baseless accusations. Depending on the type of product, it may be a more frequent type of theft. Small electronics are valuable and easy to hide, for example.

Spoilage

Inventory shrinkage just refers to unsold inventory. That doesn’t necessarily mean that it’s missing; it’s just that a business can’t sell it to a customer. For example, shrinkage is a big issue in the restaurant industry, where they almost exclusively use perishable goods.

Human error

When all is said and done, human error is a constant. You can’t eliminate it entirely, no matter how hard you try. Maybe one specific employee was tired, maybe the shipping company didn’t secure things as tightly as normal. Whatever the case, there’s bound to be human error present in some way.

Ways to reduce shrinkage

To be clear, eliminating inventory shrink is nearly impossible. There’s simply too many moving parts, and at the end of the day, human error is a constant. However, that’s not to say there aren’t ways to protect yourself from inventory shrinkage and ensure you keep it to a minimum.

Practice lean operations

Lean inventory is a method that minimizes the amount of inventory that a business carries. You can think of it like this: if “normal” inventory is an ocean, lean inventory is a river. It means carrying little to no surplus. Instead, lean businesses carry just enough to fulfill orders. This lowers overall operation costs and reduces the number of errors by reducing the amount of inventory. A good example of this would be just-in-time inventory (JIT).

Perform regular counts

Counts are an essential part of staying on top of inventory. Regular counts keep information accurate. However, they’re a massive undertaking, so doing them too often could result in a lot of operational downtime. It’s best to plan them on a periodic schedule and stick to it.

Use inventory software

Another great way of reducing errors is by using software. Computers can complete simple tasks much quicker than humans and with fewer errors. These errors are also usually easier to fix or solve. For example, an inventory management system tracks product flow in real-time– and will help you identify where inventory went missing.

How inFlow can help reduce inventory shrinkage

Trust me, we know how frustrating inventory shrinkage can be. It’s one of the common reasons some customers have started using our inventory management software, inFlow.

Our software gives users real-time inventory tracking with multi-location support. We have a built-in barcoding system to help reduce human errors and speed up your workflow, a robust reporting feature, and stock-level alerts. We even allow you to restrict user access, which will help reduce theft.

So, if you want to start reducing your inventory shrinkage, consider giving inFlow a try. We promise you won’t regret it!

0 Comments