Key takeaways

- The inventory turnover ratio measures how quickly inventory is sold within a specific timeframe.

- It is used to indicate sales efficiency and product marketability, empowering businesses to make informed decisions.

- The inventory turnover ratio formula is: Inventory Turnover Ratio = (Cost Of Goods Sold) / Average Inventory.

- To calculate average inventory, you can use the average inventory formula: Average Inventory = (Beginning Inventory + Ending Inventory) / 2.

- A high inventory turnover ratio suggests efficient sales and inventory management, while a low turnover may indicate overstocking or sluggish sales.

- This ratio aids in identifying slow-moving items, optimizing stock levels, enhancing demand forecasting, and improving cash flow.

The inventory turnover ratio for each of your products can help you determine how marketable your goods are and how effective your marketing is. This is why knowing the inventory turnover formula is useful.

Inventory turnover is a crucial measurement for understanding how your business is performing. This metric can help you make more informed decisions regarding manufacturing, buying products, storing inventory, marketing, and selling goods to customers.

What is inventory turnover ratio?

Inventory turnover is how fast (or how many times) you can sell through your inventory during a specific timeframe. A high turnover rate often means you’re selling your goods quickly and efficiently. A low turnover rate can indicate that sales are slow or that you’ve overstocked. Stock turn, stock turnover, and inventory turns are other common names for inventory turnover ratio.

How can you use inventory turnover ratio?

Analyzing your company’s inventory turnover ratio is a great way to find out more about your business operations. It can be an indication of how well you manage your inventory and ensure you’re not carrying excess inventory.

Here are some ways you can use inventory turnover ratio:

- Identify slow-moving inventory—monitoring your inventory turnover is a great way to identify products that are stagnant, eating away at your carrying costs.

- Optimize inventory levels—a low or high inventory turnover ratio will give you insights into whether you should be carrying less or more of a particular item.

- Improve demand forecasting—when you know how well your inventory is moving you can make more accurate predictions for future inventory needs.

- Increase cash flow—once you’ve identified products that aren’t moving well you can reduce the amount of inventory you carry which will ultimately increase your cash flow.

For more of an explanation of inventory turnover, check out this video:

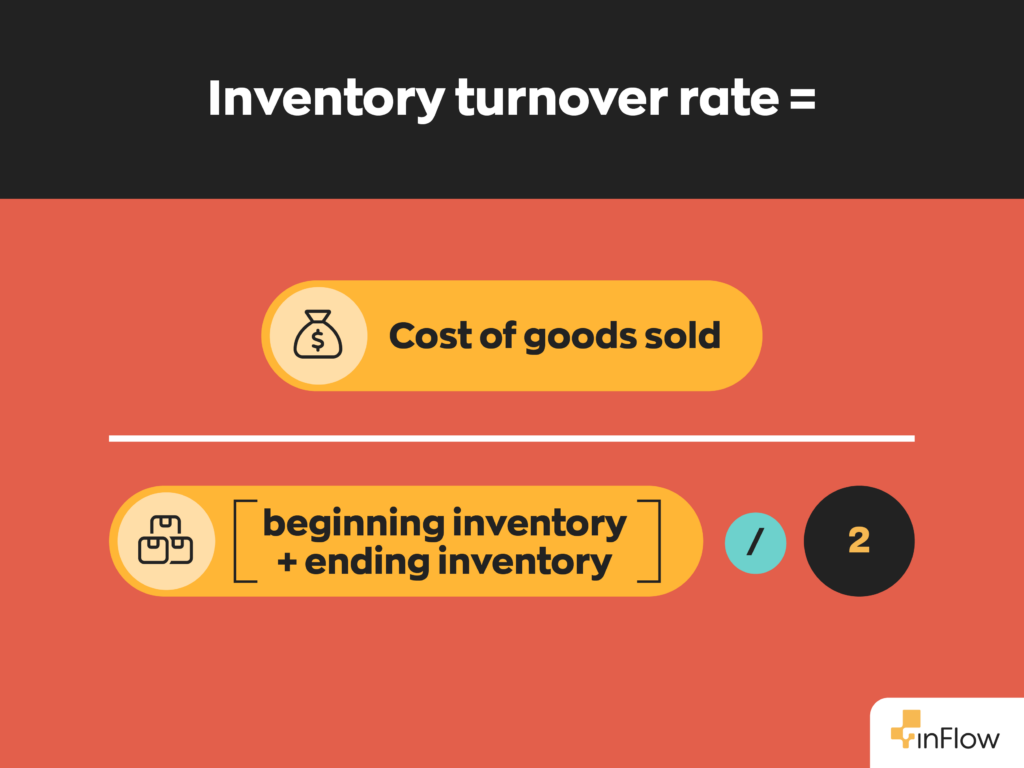

What is the inventory turnover ratio formula?

To calculate inventory turnover, let’s define the variables:

- Timeframe = 1 year (or whatever period you choose)

- Average inventory = (the dollar value of beginning inventory + ending inventory) / 2

- Cost of goods sold (COGS) = the number on your annual income statement

With those variables identified, you can now use this formula to calculate the inventory turnover rate:

Cost of goods sold / average inventory = inventory turnover rate

Inventory turnover ratio example

Let’s say you own a bookstore, and you’re trying to figure out inventory turnover for one of your best sellers. Your COGS is $10,000. Your beginning inventory is $3,000, and your ending inventory is $1,000—so your average inventory is $2,000 ($3,000 + $1,000 and then divided by 2). If we plug those numbers into the formula, we get:

$10,000 (your COGS) / $2,000 (your average inventory) = 5 (your turnover rate)

In other words, you turned your inventory for that book five times throughout the year. From here, you can average out how many days it takes to sell through your inventory one time. Take 365 days and divide it by 5 (your inventory turnover rate).

365 / 5 = 73

In this example, it takes 73 days to sell through your average inventory one time. This number will help inform how much stock you need to order in the future and how many sales you can expect to make throughout the next year.

We know it can be a pain to keep all of these formulas straight. So we decided to create a handy Inventory Formula Cheat Sheet with 7 of the most common inventory formulas.

Download your inventory cheat sheet now!

Inventory turnover rate vs. sell-through rate

Inventory turnover ratio measures how many times you sell through and replace inventory (SPEED) in a specific period. Sell-through rate is a bit different. It measures how much stock you sell in a given period (AMOUNT) as a percentage.

(Quantity of goods sold / quantity of goods on hand) x 100 = sell-through rate

Your business needs to maximize both of these rates. A high turnover means you’re selling through items efficiently, and a high sell-through means you’re turning over a high quantity of items.

Days sales of inventory (DSI) vs. inventory turnover

Days sales of inventory (or days of inventory) calculates the average time it takes your business to turn inventory into sales. You can calculate DSI by taking your average inventory and dividing it by the cost of goods sold. Then multiply that number by 365, and you’ll know how many days it takes to sell your inventory. The smaller this number is, the better.

(Average inventory / cost of goods sold) x 365 = days of inventory

Other inventory calculations you should know

Asset turnover ratio

Your company’s asset turnover is your total sales ratio to the average value of your assets. You can use this formula to identify how efficiently your business uses your assets to generate sales and revenue. The higher your asset turnover ratio is, the better. To calculate this ratio:

Total annual sales / average assets = asset turnover

You can calculate your average assets by taking the value of your assets at the start of the year added to your assets at the end of the year. Then divide that number by two.

(Beginning assets + ending assets) / 2 = average assets

Inventory holding period

Your inventory holding period is how long (in days) your company holds inventory on average. The lower the holding period, the better it is. Calculate the holding period using the following formula:

(Inventory / cost of sales) x 365 = holding period

What is a good inventory turnover ratio?

The ideal ratio depends on what you’re selling and your specific industry. Some goods sell immediately, like toilet paper. Other goods can take much longer to sell, like fine artwork. An art gallery may have a turnover rate of three when a grocery store’s average is 15. It’s common for businesses with higher profit margins to have lower inventory turnover and vice versa.

When determining whether your inventory turnover ratio is good or bad, you need to compare it to how other businesses in your industry are performing. In other words, compare your apples to other apples—not oranges or mangos.

In general, the higher your inventory turnover rate is, the better. A higher rate can indicate one of two things:

- Sales are strong: Your business is selling inventory effectively and efficiently.

- Inventory is too low: If you run out of stock because you’re selling through products too quickly, you could end up losing sales.

Conversely, if your inventory turnover ratio is too low, you could face these types of problems:

- You’ve overstocked: You could be paying high storage and holding costs.

- Sales are weak: Your business isn’t selling efficiently.

- Marketing is inadequate: You’re not reaching and connecting with people effectively.

Going with the same example we used before, compare your inventory turnover rate of “10” with other bookstores in your area. All you need is their income statement and balance sheet.

If your competitors turn their top sellers faster than you do, you should analyze how their shop is marketing and selling books compared to yours and make adjustments as needed. Look at industry averages across the nation for bookstores that are similar in size and scope. Then you’ll have a good idea of whether your turnover rate is high, low, or average for your industry.

How can I improve inventory turnover for my business?

If you’ve used the inventory turnover ratio formula, and you know you need to improve your averages, we have several tips.

1. Try a new marketing strategy.

Make sure you set up your campaign to target your ideal customers. Tell them how you can solve their specific problems and how fantastic your solution is. Get people excited about what you offer, so they can’t wait to get their hands on it.

2. Choose products that sell well.

What do you have in your store that already gets a lot of hype and has a high turnover rate? Maybe you should find similar products to offer your customers.

3. Group similar inventory.

You can create “inventory groups” by identifying similar products. By placing them in the same category, you can compare how they perform on the shelves. This can help you recognize trends and project how much product you should order in the future.

4. Get rid of stuff you just can’t sell.

If you have a product that’s been taking up shelf space or warehouse space, but it doesn’t sell well, you may want to consider getting rid of it. If it’s only taking up valuable space, you’re losing money.

5. Double-check your prices.

If you’re already applying all of the other tips in this list and you’re still not making sales, your pricing could be too high. Compare your prices with similar businesses and products in your industry. If other companies are pricing things much higher or lower, change your pricing to be more competitive.

6. Buy smaller quantities more frequently.

An easy way to increase your inventory turnover rates is to buy less and buy more often.

How the inventory turnover ratio can help eliminate dead stock

Understanding your inventory turnover ratio is important for every business, but some companies can benefit from it more than others. For example, if you were working with perishables or other time-sensitive goods like fashion or electronics. Using the information available to you through the use of the inventory turnover formula will allow you to make more informed decisions when it comes time to reorder stock.

Demand is bound to change with the times. Staying on top of how much inventory you’re selling will ensure you don’t encounter any stockouts and simultaneously reduce the chances of creating any dead stock.

Limitations of using the inventory turnover formula

If you aren’t comparing apples to apples, as we mentioned already, the inventory turnover ratio won’t give you accurate insight into how your business is performing. Make sure you’re accounting for discounts on items throughout the year, special campaigns or offers, and markup. That way, you can use this formula effectively and improve your tactics over time.

Powerful software to increase your inventory turnover

inFlow is stocked with impressive features to help you grow your business and track your results. Our software will help you find the perfect balance for supply and demand, so you know exactly how much inventory to order and when to order it. If you’re using barcodes or thinking of implementing them, inFlow can help with that too! Read our Ultimate Barcoding Guide to learn more about barcodes including how to get started barcoding your business.

Twelve-month inventory turns for a month for the Company based solely on new purchases over the trailing twelve months. How it can be calculated.

Hey Pawan,

Thanks for reading. You said you turn twelve months of inventory for one month. So using the inventory turnover ratio formula you would take the dollar value of your inventory at the beginning of that month and add it with the value of your inventory at the end of the month and divide that number by 2. This will give you your average inventory for that month. If you take your COGS for those same products for the month and divide it by your average inventory you’ll get your inventory turnover ratio. I hope this helps.

Cheers,

Jared

In case where Opening Inventory is “zero” and closing inventory is 500000 what will be my Average inventory in the above situation while calculating Inventory Turnover Ratio

Hey Sri,

Thanks for reading. To answer your question you would take your beginning inventory ($0) add it to your ending inventory ($500,000) and then divide by 2, which would make you average inventory $250,000. I hope this helps!

Cheers,

Jared

Great post! I’ve been looking for a simple and intuitive way to calculate inventory turnover ratio. Your formula is easy to understand and I’m excited to apply it to my business. Can’t wait to see how it improves my inventory management.

Hey Mp3 juice,

Thanks for reading! We’re super glad you liked it! I’m confident it will help improve your inventory management in no time.

Cheers,

Jared

Thank you so much for this post. I am a buyer in retail and am grateful to have found this post. It really is going to make my inventory management much easier and effective.

Hey Godbless Dera,

We’re glad you enjoyed the article! We love helping out whenever we can. Inventory management can be a real nightmare, so we love to help out whenever we can. Please consider subscribing to our newsletter below so you can stay up to date on all our new content.

Cheers,

Jared

Lets say I am calculating my turns monthly…how do I calculate a COGS that makes sense? Should I annualize the COGS or just calculate using the month total? Average the number of months in the year? (if I am in March, take YTD COGS *$ to annualize?)

Hey Paul,

Thanks for reading. If you’re looking to calculate your turns for the month the most accurate way would be to use your totals from that month. You could calculate for the entire year and just divide by 12 to get the monthly average but this won’t give you as accurate and detailed COGS. This is especially true if your business experiences a lot of fluctuations in inventory levels due to seasonality shifts. I hope this helps!

Cheers,

Jared

“Download your inventory cheat sheet now!” is a dead link

Hey Buster,

Sorry about that. It should be working now. If it’s still not working, please feel free to email me at jared@inflowinventory.com, and I can send the cheat sheet over to you.

Cheers,

Jared