Currency has value. That simple fact is what enables businesses to function. Many factors go into ensuring a currency has value and stability, but most of us accept that it does without giving it much thought. But for small businesses dealing in multiple currencies, it’s important to remember that currencies rarely have a 1:1 value. This difference in international currency values has varying effects on your overall profit, which is why understanding the mid-market exchange rate is essential.

In this blog, we’re getting into the nitty-gritty of the mid-market exchange rate, including what it is, how to figure out its current value, and why it’s so important.

What is the mid-market exchange rate?

When working with different currencies, there are two important data points to consider: the bid rate and the ask rate. The bid rate is the amount someone is willing to pay for a product. The ask rate is the amount someone is willing to sell that same product for. In this case, the product in question is foreign currency. Fortunately, the formula to calculate the mid-market rate is simple. It’s as follows:

As shown in the formula above, the mid-market exchange rate (also known as the mid-market rate) is the midpoint between the ask rate and the bid rate. Here’s an example to help illustrate. It’s also important to note that the mid-market exchange rate is really an ideal. You won’t always be able to hit that ideal.

For the sake of this example, we’ll use the US dollar ($) and the Euro (€). Do note that the values below are not the real-world values.

Let’s say that for a single Euro, the bid price is 1.30 USD, and the ask price is 1.20 USD. The midpoint between these two values is 1.25. This means that the mid-market exchange rate for these two currencies is 1.25.

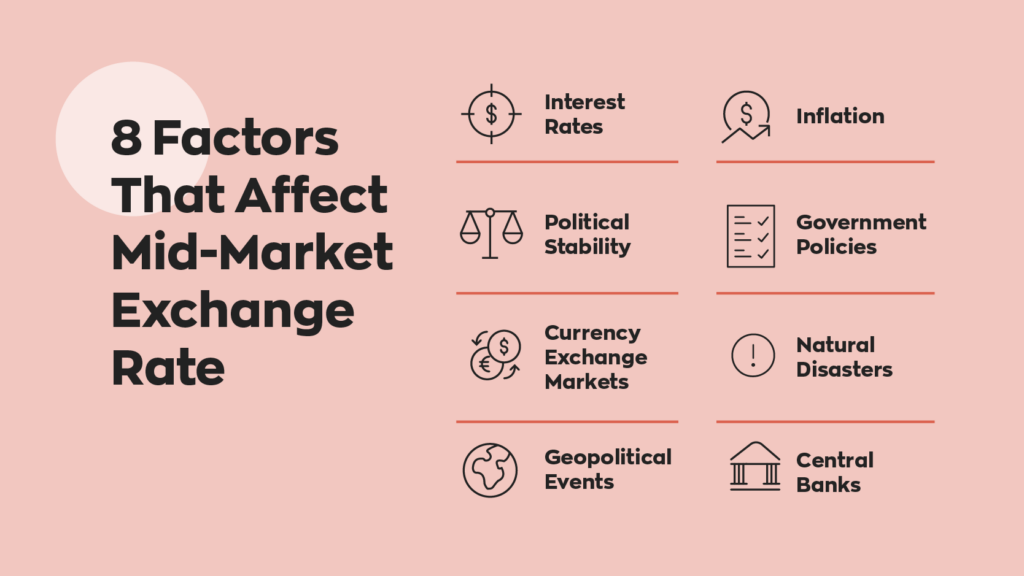

What affects the mid-market exchange rate?

Two main factors affect the mid-market rate. The first is banks, as they tend to hold the majority of available currency, and the second is the market as a whole. Of course, these are not the only two factors behind the conversion rates.

- Central Banks – For the most part, banks perform the majority of currency transactions/conversions across the globe. This naturally gives them quite a bit of influence over conversion prices. However, this does not give them complete control– far from it.

- Currency Exchange Markets – While banks influence the mid-market rate, they don’t control it. After all, no one will buy from them if their ask rate is too high. On the other hand, if it’s too low, there’s a good chance they’ll end up losing money to market shifts.

Outside of these two significant factors, there’s also a variety of minor factors that act to set prices. These vary from region to region, as different countries specialize in different industries. Some imports/exports have naturally volatile supply lines, and others are affected by the season.

There’s also the chance of a global-scale event happening, like COVID. Political strife or discourse can also affect the mid-market exchange rate on a larger but not-so-global scale. In short, lots of little things can affect a currency’s global value. And quite a few of them have to do with a country’s day-to-day operations.

Why is mid-market rate important?

At first glance, it might seem like the mid-market exchange rate only affects international businesses. The truth, though, is a little different.

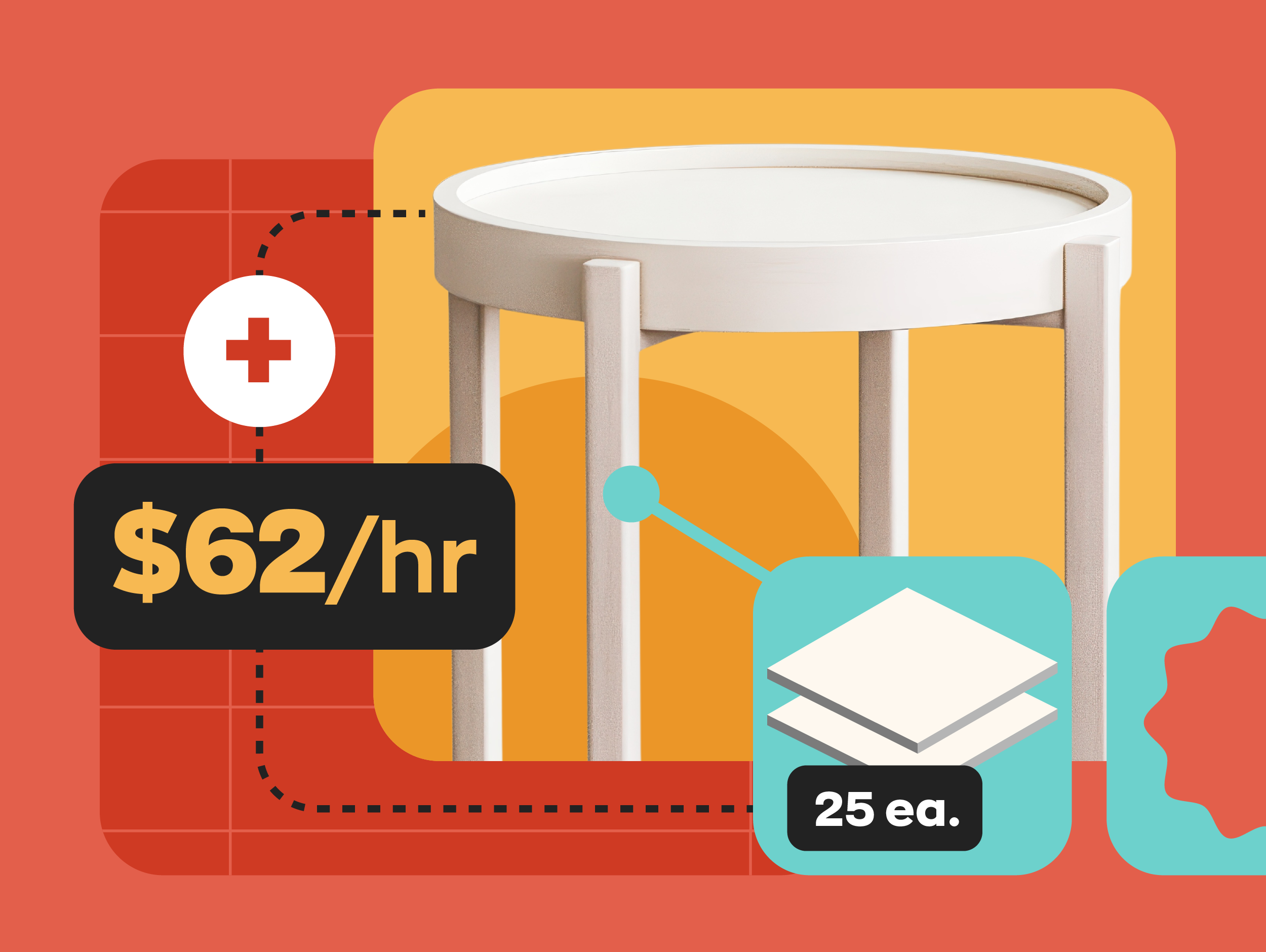

Even businesses that operate in a single region should diversify their product supply chains. In many cases, purchasing internationally is an excellent way to do that. That means purchasing products in different currencies, which means you’ll have to account for differences in currency value. That, in turn, means dealing with the mid-market exchange rate.

We mentioned before that the mid-market rate is an ideal. It’s not something that’s legally binding, and it’s rare to meet it exactly. The currency exchange industry is a business, after all. There can also be a commission fee of some sort if you’re buying currency outright.

The mid-market exchange rate is a tool businesses use to promote transparency across borders. Companies can use the mid-market rate to determine what kind of exchange fee services impose on them. This helps others avoid exchanges that bake in too many fees or lie about their rates.

What tools can you use to help with currency exchange rates?

If you don’t know the mid-market rate, you open yourself up to getting ripped off. So, knowing the mid-market rate is essential, but that doesn’t make it easy.

As most people know, the value of most currencies changes on a regular basis. It doesn’t change enough to affect most people in-country, but it’s a different story for a business operating internationally. You’ll end up paying different prices for your inventory on different days, and you need to keep track of these fluctuations to maintain your desired profit margins. So, how do you keep track of the mid-market exchange rate? Well, there’s a few different ways.

If you really want to, you can keep track of it manually. Free resources like Xe calculate the mid-market exchange rate in real-time. That’s all it does, though, and the website explicitly states that you won’t get that rate when converting.

Even with the help of something like Xe, manually keeping track of the mid-market rate will take time and effort. And if there is one thing we love here at inFlow, it’s saving small businesses time, which is why we recently introduced an integration with Open Exchange Rates.

How does the integration work? Well easy! If you haven’t saved any manual conversion rates for your products, inFlow will default to using Open Exchange Rate once daily to pull in the mid-market rate. That means there is no need for formulas or manual tracking!

This new feature we’ve added is just the icing on the cake. We also have everything your business would need in inventory management software, whether you’re a retailer, wholesaler, manufacturer, or working in construction and field services.

Wrapping up

And there you have it!

Working with multiple regions and currencies is an inherently difficult task. Aside from researching international legislation, keeping track of the mid-market exchange rate can be tricky. But despite its difficulty, it’s an extremely important part of running a business.

If you don’t keep a close eye on it– and make sure that you’re receiving acceptable rates– you could very well find yourself losing quite a bit of money.

0 Comments