How to set inFlow’s costing method (Moving average, FIFO, etc.)

Before beginning to sell, it’s crucial to select how inFlow will calculate the cost. This is necessary for accurate tracking of product costs. Look below to learn about the costing options.

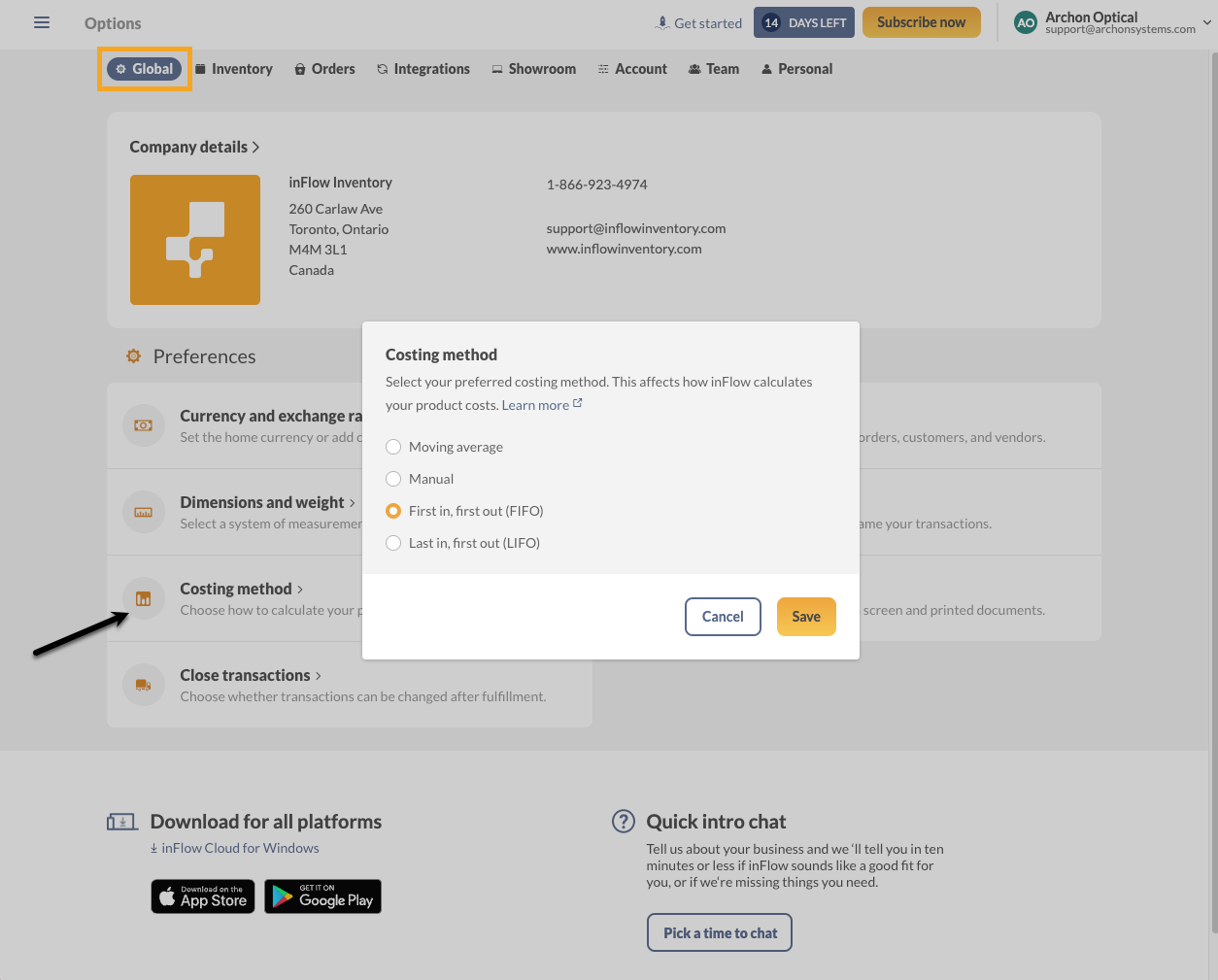

Web

Check out the Setting up the Basics video below for step-by-step instructions on how to change your costing method starting at the 2:32-minute mark.

To choose/change your costing method

The default costing method is Moving average costing. If you’d like to change this setting, see below.

If you’ve been using inFlow, be sure to back up your product details to a CSV file before making any changes.

- Open the Global inFlow settings (Main Menu>Options.)

- Select Costing method.

- Select the desired costing method, then click Save.

- Type CONFIRM in the type-in field, then select Proceed.

- inFlow will start recalculating. This could take some time, depending on how much data is in inFlow.

Backing up product costs

If your team has been using inFlow and you’ve decided to change the costing method, we recommend backing up your product costs in a CSV file before making changes.

- Go to Main Menu > Export data.

- Select Product details from the Data Type options.

- Click Export to save the CSV file to your computer.

Which costing method should I choose?

If you’re wondering which costing method you should choose for your business, that depends. Here’s how the calculation works for each costing method.

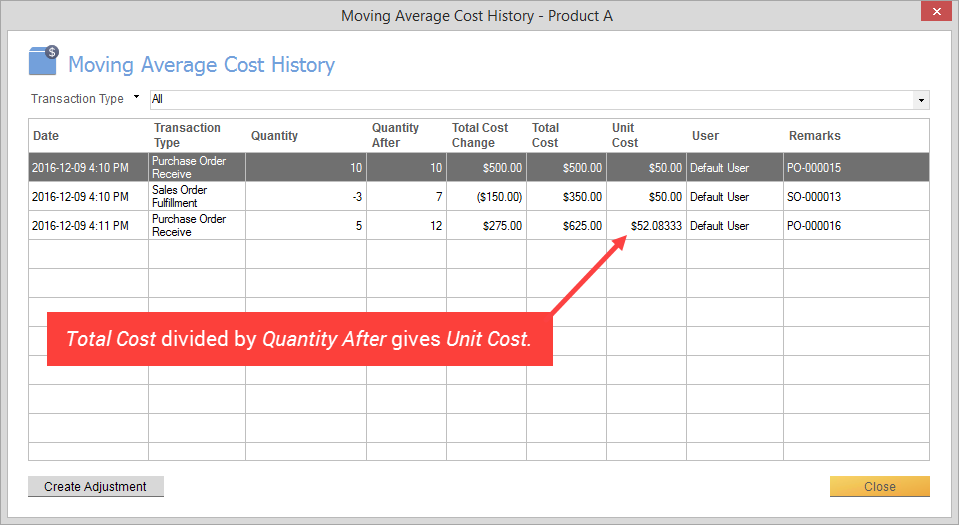

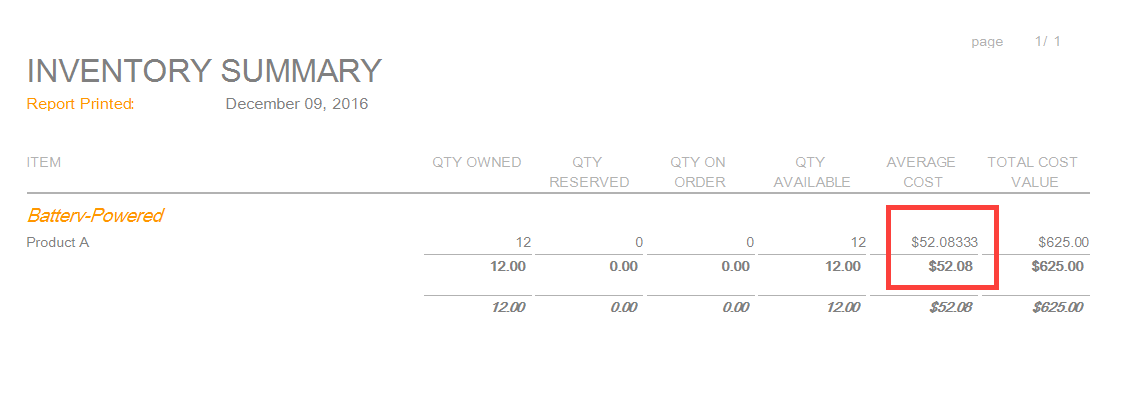

Moving average costing method

Moving Average cost re-calculates the average cost of each inventory item in stock after every purchase. This calculation would take the total cost of the items purchased divided by the number of items in stock. Here’s a calculation example:

Let’s start with 10 quantities of Product A, and the unit cost is $50.

A sales order is then raised for 3 of Product A. You are left with 7 quantities.

Now you’ve reordered 5 more of Product A, but the vendor price has changed to $55 (or shipping is added this time — anything that will amount to the cost being different than the original $50).

Your current cost would be calculated using the formula: Total cost / Total quantity

Old cost ($50 x 7) + New cost ($55 x 5) ÷ 12 (total quantity) = $52.08333

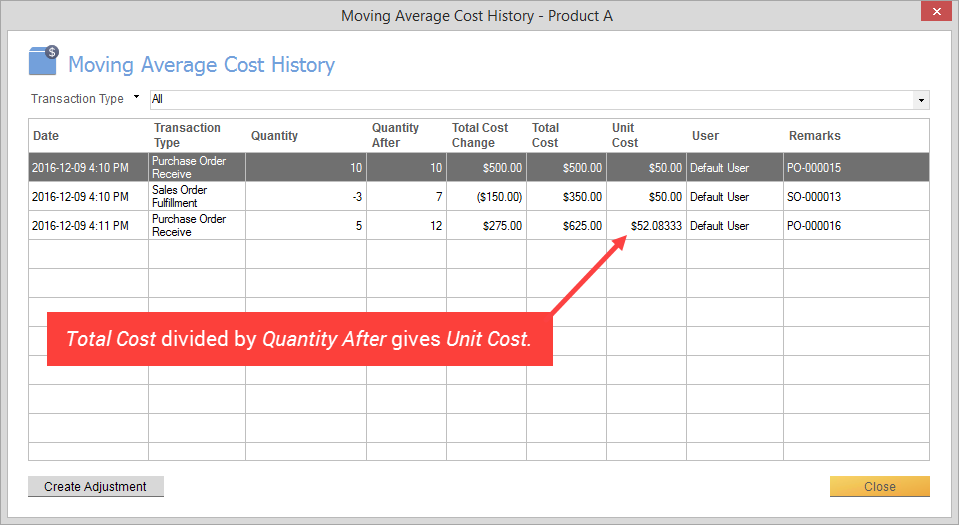

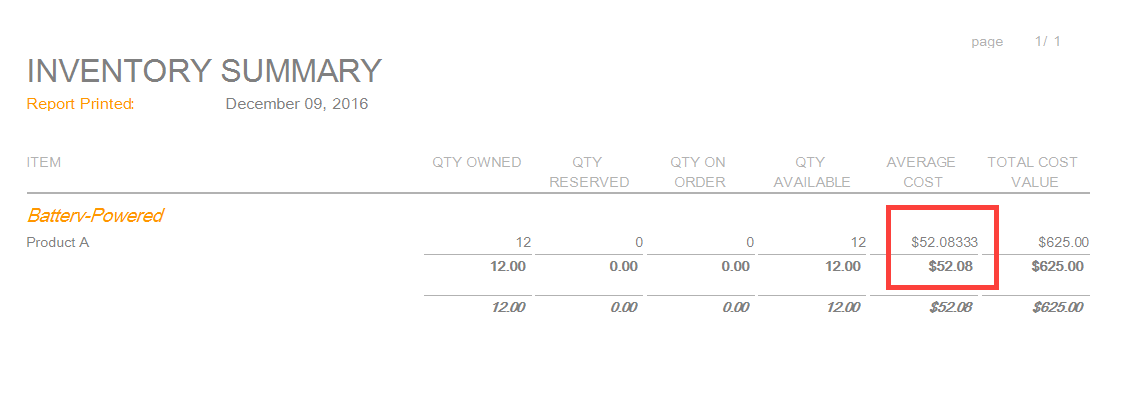

This calculation can be viewed via the moving average cost history.

Cost History is only available to view in inFlow Inventory for Windows.

Manual costing method

Manual cost does not change until you update it manually in the product record and is unaffected by purchase orders at all. Use this method if you prefer to calculate your product cost manually (outside of inFlow) and if your cost doesn’t fluctuate too much. You would have to review your costs each year (or term) as your vendor prices may rise since purchase orders don’t affect this cost, unlike the rest of the costing methods.

As an example, if you’ve calculated the cost of “Product A” to be $50, simply go to the record and set the cost as $50. That’s it!

Services and Non-Stocked type items always use Manual cost, no matter what you’ve set as your system-wide costing method.

FIFO costing method (First-in, First-out)

This method of costing means that the oldest inventory items (first-in) will be sold first (first-out). Therefore your oldest purchasing costs will be used to calculate your profit at the time of that sale. Here’s the example again using Product A.

We’ll start once again with 10 quantities of Product A, and the unit cost is $50.

We’ll sell 3 of these products to a customer, and the cost of goods sold would be $50 x 3 = $150.

At some point, let’s say you’ll need to purchase more, and you go ahead and purchase 5 more for $55.

If you check your product record, you might see the cost as $50. This is correct, as you’ve still got old stock with that cost. Your first sales of the initial 10 quantities will use the initial cost of $50 until you hit the new stock cost of $55.

Note that because of the layered costing within a single product, inFlow cannot show each cost layer in the reports. It can only show an average.

LIFO costing method (Last-in, First-out)

LIFO is a similar layered costing method to FIFO, except it uses the newest stock / newest cost in your sales. Using the same purchasing example above:

We’ll be starting once again with 10 quantities of Product A, and the unit cost is $50.

Then, sell 3 of these products to a customer (cost of goods sold = $50 each).

Finally, raise a new purchase order for 5 more at $55 each. You’ve now got 12 quantities total of Product A.

Any new sales order past this point will use the cost of $55 since that’s the cost of your newest stock. After the first 5 have been sold, the remainder 7 will use the cost of $50 (old cost).

Similar to the FIFO costing method, the reports can only show an average cost.

Stock adjustments and FIFO/LIFO costing methods

To ensure the most accurate costs, it’s recommended to add new products to your inventory using a purchase order that reflects the latest costs.

However, if you want to make a quick stock adjustment, inFlow will apply the current cost for products added through a stock adjustment using FIFO or LIFO costing methods.

Serialized product costs

You can only update the costs of serialized products with purchase orders for all costing methods in inFlow for web and mobile.

Looking for more info?

Perhaps you’d like to know how to adjust your cost or what to do if the cost has been reported incorrectly.

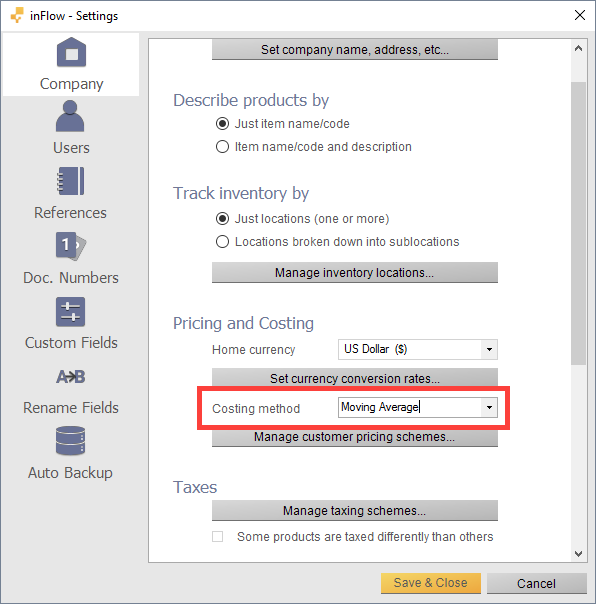

Windows

To choose/change your costing method

The default costing method is Moving average costing. If you’d like to change this setting, take a look below.

If you’ve been using inFlow, be sure to back up your product details to a CSV file before making any changes.

- Go to the Main Menu > Options > Settings.

- Select which costing method you’d like to use

- Click Save and Close. This may take some time if you’ve already been using a different costing method.

Backing up product costs

If your team has been using inFlow and you’ve decided to change the costing method, we recommend backing up your product costs in a CSV file before making changes. If you’re setting up inFlow, you can skip to To choose/change your costing method below.

- Go to Main Menu > General > Export data.

- Select Product details from the Data Type drop-down menu.

- Click Export to save the CSV file to your computer.

Which costing method should I choose?

If you’re wondering which costing method you should choose for your business, that depends. Here’s how the calculation works for each costing method.

Moving average costing method

Moving Average cost re-calculates the average cost of each inventory item in stock after every purchase. This calculation would take the total cost of the items purchased divided by the number of items in stock. Here’s a calculation example:

Let’s start with 10 quantities of Product A, and the unit cost is $50.

A sales order is then raised for 3 of Product A. You are left with 7 quantities.

Now you’ve reordered 5 more of Product A, but the vendor price has changed to $55 (or shipping is added this time — anything that will amount to the cost being different than the original $50).

Your current cost would be calculated using the formula: Total cost / Total quantity

Old cost ($50 x 7) + New cost ($55 x 5) ÷ 12 (total quantity) = $52.08333

This calculation can be viewed via the moving average cost history.

Cost History is only available to view in inFlow Inventory for Windows.

Manual costing method

Manual cost does not change until you update it manually in the product record and is unaffected by purchase orders at all. Use this method if you prefer to calculate your product cost manually (outside of inFlow) and if your cost doesn’t fluctuate too much. You would have to review your costs each year (or term) as your vendor prices may rise since purchase orders don’t affect this cost, unlike the rest of the costing methods.

As an example, if you’ve calculated the cost of “Product A” to be $50, simply go to the record and set the cost as $50. That’s it!

Services and Non-Stocked type items always use Manual cost, no matter what you’ve set as your system-wide costing method.

FIFO costing method (First-in, First-out)

This method of costing means that the oldest inventory items (first-in) will be sold first (first-out). Therefore your oldest purchasing costs will be used to calculate your profit at the time of that sale. Here’s the example again using Product A.

We’ll start once again with 10 quantities of Product A, and the unit cost is $50.

We’ll sell 3 of these products to a customer, and the cost of goods sold would be $50 x 3 = $150.

At some point, let’s say you’ll need to purchase more, and you go ahead and purchase 5 more for $55.

If you check your product record, you might see the cost as $50. This is correct, as you’ve still got old stock with that cost. Your first sales of the initial 10 quantities will use the initial cost of $50 until you hit the new stock cost of $55.

Note that because of the layered costing within a single product, inFlow cannot show each cost layer in the reports. It can only show an average.

LIFO costing method (Last-in, First-out)

LIFO is a similar layered costing method to FIFO, except it uses the newest stock / newest cost in your sales. Using the same purchasing example above:

We’ll be starting once again with 10 quantities of Product A, and the unit cost is $50.

Then, sell 3 of these products to a customer (cost of goods sold = $50 each).

Finally, raise a new purchase order for 5 more at $55 each. You’ve now got 12 quantities total of Product A.

Any new sales order past this point will use the cost of $55 since that’s the cost of your newest stock. After the first 5 have been sold, the remainder 7 will use the cost of $50 (old cost).

Similar to the FIFO costing method, the reports can only show an average cost.

Serialized product costs

You can only update the costs of serialized products with purchase orders for all costing methods in inFlow for web and mobile.

Looking for more info?

Perhaps you’d like to know how to adjust your cost or what to do if the cost has been reported incorrectly.

0 Comments